An educational blog which supplements subscriber service Chart Patterns are nothing but Footprints of the Greenbacks.

Monday, June 15, 2009

SPX gap filled

Friday, June 12, 2009

The picture of indecision

Thursday, June 11, 2009

Market Talk

Wednesday, June 10, 2009

Market Talk

Tuesday, June 09, 2009

Market Notes

Monday, June 08, 2009

Market Talk

Friday, June 05, 2009

Charts

Murky out there

Foggy

Wednesday, June 03, 2009

Free Newsletter

Monday, June 01, 2009

More Trades

We were looking for a trade on DIA at 86 -- it gapped above but then pulled back within a nickel of our spot.

We were looking for a trade on DIA at 86 -- it gapped above but then pulled back within a nickel of our spot.Friday, May 29, 2009

More inflation Talk

Good article in Seeking Alpha today if you're interested in adjusting your portfolio for inflation (and it seems like traders have done exactly this all month long):

With inflation worries starting to surface and the US Dollar resuming its fall, many investment advisors have advocated the iShares Barclays TIPS Bond Fund (TIP). This ETF invests in Treasury Inflation Protected Securities, treasury bonds which promise to completely protect against inflation by calculating the coupon payment on inflation-adjusted principal.

The TIP is a smartly designed fund with an attractive expense ratio and plenty of liquidity. But it has one fatal flaw: TIPs haven't been tested in truly inflationary times, and are thus a much riskier investment than most people think.

The protective value of TIPs rests on an accurate calculation of inflation. Critics have long accused the CPI of underestimating the true value of inflation. Much like the unemployment figures, the CPI numbers have beenopenly massaged over time to look more benign. They aren't falsified per se, the index's parameters are simply changed in a way that produces overly conservative figures.

TIPs were first issued in 1997, smack in the middle of the "great moderation". They weren't tested in the 1970's. We don't know if the US government will pay them back honestly and in full. It may simply be easier and cheaper to lower the CPI numbers, leaving TIPs holders exposed. This excellent Bloomberg story describes how poorly TIPs performed in early 2008, right when pre-crisis inflation hit its peak.

The pressure on the US government to fiddle the inflation numbers will be overwhelming the next time inflation rears its head. The Fed wants to keep rates low to support growth. The Treasury wants to keep rates low to avoid raising its borrowing costs, both through higher interest payments and higher TIPs payouts. Every government in the world fudges their inflation numbers, and history has shown that the worst fudging comes in times of the worst inflation. With the US fiscal situation looking more and more dire, investors cannot rely on the flawed CPI to protect them.

Better, safer alternatives exist. The SPDR DB International Government Inflation-Protected Bond Fund (WIP) invests in inflation protected securities from a variety of non-US issuers. WIPs holdings are better credit risks, and their geographic diversity minimizes the chance that any one particular government will hurt your returns.

The ProShares Ultra Short 20+ Year Treasury (TBT) shorts the long end of the US treasury curve . Unlike the CPI rate, long term treasury rates are set by the market. (Although the federal reserve has recently tried to artificially support prices with quantitative easing, its policy has clearly failed.) As inflationary expectations rise investors will demand more yield for long term treasuries, causing prices to fall and TBT to rise.

Investors with more risk tolerance may want to invest directly in commodities, which are usually big winners in inflationary environments. Top picks would include the SPDR Gold Shares Trust (GLD), the Powershares DB Commodity Index (DBC), and the Powershares DB Agriculture (DBA). If you absolutely must invest in TIP, make it a small part of an inflation proof portfolio that includes exposure to international government bonds and commodities.

Disclosure: Author owns TBT.

Good opportunities

We always tell new traders that trading is harder than it looks, but what you always need, whether you are new at the game or a grizzled veteran, are opportunities. And providing trading opportunities is what HCPG is all about:

Thursday, May 28, 2009

TBT holders don't be piggish

The trend in the commodity stocks is still intact, but TBT holders might want to take some off the table as treasuries look like they've put in at least a short-term bottom.

Wednesday, May 27, 2009

Dealing with a psycho market

Tuesday, May 26, 2009

Dip Buyers Win Again

Saturday, May 23, 2009

SPY Talk

No predictions as to which direction this small range (88-90) will break but we'd prefer a move down to the 50SMA to give this potential March bottom a broader base and more backing and filling.

Point A is the trend-line that we broke and keep visiting from the other side. Point B is support, and Point C is resistance.

Friday, May 22, 2009

Get your lawn chair out

Wednesday, May 20, 2009

Day Traders get their day

These are ALL the stocks that triggered from last night's newsletter, losers and winners.

ACI 18 worked well if you were fast.

CLF 25.

CNX 40.5

GNK 21

JRCC 24

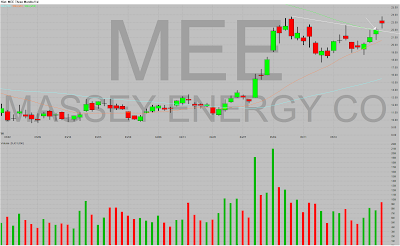

MEE 21.4

Best set-up of the day goes to base and break 1 point under daily spot on MON (91 base and break under 92 daily spot).

NEM 44.75

PCU 20

TBSI 10.5 didn't work. We don't like trading sub-$20 stocks and regret putting this one on the letter.

VMW 29 excellent set-up for a big size/close stop trade (as opposed to wider stop/fewer shares trades we recommend on commodities).

Tuesday, May 19, 2009

Suspense Continues

Monday, May 18, 2009

Monday morning green shoots

We would have much preferred a visit to the 50SMA but the bulls went with the news and didn't relinquish an inch to the bears all day long.

It's hazy out there and we're sticking to pure day-trading as we can't see a clear direction on the SPY. On one hand it looks like we're going to go visit the 200 SMA and resistance at 94, but on the other hand volume was light and this one-day bounce will need continuation before it can be believed. Much too blurry for our taste (and the few number of set-ups we have for tomorrow reflects this).