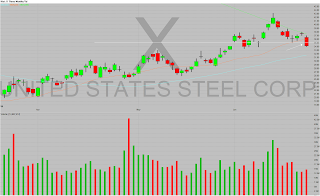

We had listed MR 30 on our newsletter for a while now and today it finally broke out. The volume was good and the set-up was excellent. Let's go through it with some more detail:

At point A the stock approaches the 30 resistance spot but the angle of ascent is too vertical and the stock reverses. The stock then bases and digests the move before approaching resistance again -- at this second attempt (with its excellent relative strength and volume) it was a buy (point B) with a stop under the basing level near 29.8. At point C it was a good idea to take some partial profits on the quick pop up. The stock then reversed back to the break-out point but did not break the EMA. Note how it then proceeded to coast along the ascending EMA until it finally popped again (point D) in which further profits should have been taken. Note how the ascending EMA rides up with the stock and the stop on the remaining shares trails up with the stock.

This is a perfect example of a break-out trade using our system in the current market. We'll be posting more trades like this in the future for readers curious on how we trade.

Update: the stock reversed back to the EMA and broke it -- that was the signal to exit remaining shares (unless swinging in which case you would have a stop under 30).