What do you do when your system fails you? The question is an important one for traders and is one that most likely we all have asked ourselves at some point in our trading careers. This question demands another question, and that is, for how long has your system failed you and for how long was it successful before that? For one day, one week, for six months? Today was the worst day our service has encountered thus far in its short existence of five months. We had three stocks trigger today and all three failed. Now as much as we hate getting spanked by the mother market, and even worse, causing losses for our readers, we are not worried nor depressed.

No trading system functions every day, in every type of market. We are break-out, momentum traders who use a system with a very tight stop (1%): in choppy markets we will get hit. This has always been the case and always will be. Today was the first day within our service that we had 3 triggers and 3 losses but it will most likely not be the last. All 3 stocks triggered, all reversed with the market to hit the stop loss, and then all 3 reversed yet again and at one time or another went above our alert prices. It's a perfect example of what happens in a choppy market.

What do we do? We pull back, regroup, become more cautious, and ultimately sit things out until things improve.

Now, if our trading system were brand-new to us then we might be concerned, but the years of successful experience that we carry with us give us confidence, faith, and vision. The current trading environment (which alternatively might be great for other types of traders) that is very challenging for us, will also pass. One thing we have learnt over the years is to always have perspective and take the bad, and the good, in stride.

An educational blog which supplements subscriber service Chart Patterns are nothing but Footprints of the Greenbacks.

Thursday, October 05, 2006

Friday, September 29, 2006

The Fine Line

We mentioned in our last blog that we felt that we made a mistake this month in being too conservative. Unfortunately, this is a consequence of choppy markets. On one hand, you should become more selective since the failure rate in such market environments are higher than usual. However, one has to walk a fine line between being smart and selective, and not becoming too scared and gun-shy, since in the long-run becoming too fearful of the markets can be just as damaging as being overly aggressive. We've often said that there's nothing easy in this profession, and finding this fine line of being selective and yet involved, is something that can be difficult to capture.

This is how we do it: as our readers know, we only trade from a predefined list from the night before. Therefore, when a stock hits our alert, we already know that it has a solid daily. In benign markets we sometimes take a trade with a solid daily but a questionable intraday pattern, or with mediocre volume. In these types of markets we don't do that -- we wait for the ducks to line up. The daily we already know is solid, now we wait for the intraday and the volume to confirm. If there is any element lacking -- i.e. the volume is mediocre, or the intraday is too much of a chase, then we pass.

This means we sometimes miss good moves, but it also means that we stay away from a signficant amount of failures. This is not only good for one's account, but very important for one's confidence. Stay involved, don't get scared, take your cue from the market and when things just aren't working, then know it's ok to pass. But jump back in the game the next day and start fresh. And whatever you do, don't freeze like a scared monkey.

Saturday, September 16, 2006

What does your trading look like?

Here is an excerpt of our newsletter for Monday:

As soon as we saw the market gap-up Friday morning, we were relieved that we did not have any stocks on any of our trading lists for our subscribers. Why? Because this exhausted market needed a gap-up as much as Larry King needs new suspenders. A gap-up in an extended market near resistance almost always only invites selling. It's a perfect scenario if you are already in positions and want an exit, but very much a must-avoid situation if you are a break-out trader looking for new positions. Not all gap-ups are negative though: for example, a gap-up in a market that has recently bottomed can become a very powerful trend day.

What this market now desperately needs is a shallow pull-back or some horizontal basing. As we mentioned last week, the more extended the market, the higher the chance of break-outs failing.

When novice traders talk about trading they talk about the excitement and thrill of the job. However they soon realize that the professional traders who are consistently profitable year over year are not thrill-seekers, but disciplined traders who have conquered the desire to always be in a trade. The reality of trading is that it requires an inordinate amount of discipline and patience. A lot of what we do is simply just sitting and waiting (which actually is one of the reasons we started this service-- it gave us something constructive to do while we were sitting around!)

There are times in the market when the best thing is to just sit aside. Then there are other times when you are so busy that you realize by the closing bell that your stomach feels hollow as you haven't eaten anything all day, that your eyes are burning from staring at your screens all day, and that your back is killing you from sitting tensely in one position all day. Take your cue from the market. Do not force trades -- if the set-ups emerge, take them as they come -- be that 10 trades in one day. If they do not emerge, then sit back and just watch --be that 1 trade in ten days. This is the exact same reason why some days we have 10 stocks on our lists and other times we have none. You cannot conjure up set-ups-- the opportunity has to arise or else you will do nothing but chop up your account.

Print out this sign and put it on your wall: Every Trade is a Business Transaction. What does that mean? It means that there should be a reason for every single trade -- why you enter and why you exit. Every single trade is an important business transaction that has to be thought out and given great importance. The hungry beast that devours accounts of new traders, without a doubt, is the demon called over-trading. When your trading resembles less a person playing a video game and more a person playing chess, is when you will start to be on your way to becoming a profitable professional trader.

As soon as we saw the market gap-up Friday morning, we were relieved that we did not have any stocks on any of our trading lists for our subscribers. Why? Because this exhausted market needed a gap-up as much as Larry King needs new suspenders. A gap-up in an extended market near resistance almost always only invites selling. It's a perfect scenario if you are already in positions and want an exit, but very much a must-avoid situation if you are a break-out trader looking for new positions. Not all gap-ups are negative though: for example, a gap-up in a market that has recently bottomed can become a very powerful trend day.

What this market now desperately needs is a shallow pull-back or some horizontal basing. As we mentioned last week, the more extended the market, the higher the chance of break-outs failing.

When novice traders talk about trading they talk about the excitement and thrill of the job. However they soon realize that the professional traders who are consistently profitable year over year are not thrill-seekers, but disciplined traders who have conquered the desire to always be in a trade. The reality of trading is that it requires an inordinate amount of discipline and patience. A lot of what we do is simply just sitting and waiting (which actually is one of the reasons we started this service-- it gave us something constructive to do while we were sitting around!)

There are times in the market when the best thing is to just sit aside. Then there are other times when you are so busy that you realize by the closing bell that your stomach feels hollow as you haven't eaten anything all day, that your eyes are burning from staring at your screens all day, and that your back is killing you from sitting tensely in one position all day. Take your cue from the market. Do not force trades -- if the set-ups emerge, take them as they come -- be that 10 trades in one day. If they do not emerge, then sit back and just watch --be that 1 trade in ten days. This is the exact same reason why some days we have 10 stocks on our lists and other times we have none. You cannot conjure up set-ups-- the opportunity has to arise or else you will do nothing but chop up your account.

Print out this sign and put it on your wall: Every Trade is a Business Transaction. What does that mean? It means that there should be a reason for every single trade -- why you enter and why you exit. Every single trade is an important business transaction that has to be thought out and given great importance. The hungry beast that devours accounts of new traders, without a doubt, is the demon called over-trading. When your trading resembles less a person playing a video game and more a person playing chess, is when you will start to be on your way to becoming a profitable professional trader.

Saturday, September 09, 2006

Where are the Leaders?

Part of the problem of the market right now is that it has no real leadership to speak of. Where are the leaders and what are they doing?

In the NYSE the commodities had held the throne for most of the year, especially the energy and metal sectors. Both are currently languishing, with most of the related stocks even below their 50dma. In the Nasdaq, we started out the year with leaders such as GOOG HANS GRMN AAPL SNDK BIDU NTRI AAPL SHLD RIMM. More than half of the latter now are below the 50dma (and many of these are on our short list). An acephalous market cannot make any kind of meaningful long-term move; what is necessary is that either a new crop of leaders emerges or that there is a sector rotation, something that we still have not seen this year (and no, NVEC does not count as a new leader :-)

In the NYSE the commodities had held the throne for most of the year, especially the energy and metal sectors. Both are currently languishing, with most of the related stocks even below their 50dma. In the Nasdaq, we started out the year with leaders such as GOOG HANS GRMN AAPL SNDK BIDU NTRI AAPL SHLD RIMM. More than half of the latter now are below the 50dma (and many of these are on our short list). An acephalous market cannot make any kind of meaningful long-term move; what is necessary is that either a new crop of leaders emerges or that there is a sector rotation, something that we still have not seen this year (and no, NVEC does not count as a new leader :-)

Tuesday, August 22, 2006

Four Steps in the Quest to Become a Professional Trader

Let's take it as a given that you have researched the easy stuff -- brokerages, charting software, required hardware, et cetera. Now what?

1) First you need exposure to determine what kind of trading interests you. As you will soon find out, there are many ways to earn a living in the market. Do you want to trade hundreds of times a day, exchanging thousands of shares, chasing pennies? Or would you prefer to become a swing or position trader based on daily and weekly chart patterns? Maybe possibly just a day trader looking for intraday gap break-outs? Or somewhere in between, like us, trading off of daily but mostly for day holds, on average trading 1-3 times a day. How do you get this exposure? Read different books, check out websites and blogs of active traders.

2) Find a system that you feel suits your personality. For example, we are methodological traders who like the calmness of trading from a pre-defined list every day. On average there might be only 10 stocks on our Main list to trade from, and those only at exact prices. If these prices are not reached, then no trade. Other traders, for example, live for the chase and the thrill and may only trade stocks which have released news or earnings.

3) Alright now you have honed in on an area of trading that interests you. For the sake of argument, you, like us, prefer to trade only a few times a day, based on daily charts. So now what? Now you read some books related to this type of trading, find specific websites that practice the type of trading you are interested in, and if possible, come into contact with actual traders who practice the type of trading that interests you. What books did we read and do we recommend? Well, they're a mixed bunch but we think that all of them should be read:

How to Make Money in Stocks by William O'Neill

How I made $2,000,000 in the Stock Market by Nicolas Darvas

High Probability Trading by Marcel Link

Encyclopedia of Chart Patterns by Thomas Bulkowski

4) Now you need to get your feet wet. You can start out by paper-trading but probably the best way to really gain experience is to actually jump into the market with real money. However, start small. For example, you have decided to become a break-out trader and have noticed that stock HCPG is close to breaking the downtrend line at 50. The next day HCPG breaks through 50 and you buy it. Start with 100 share trades but treat it as if it were a 1000 share lot. Now write down, be it in a written journal, or an Excel Program, every possible relevant factor. For example some categories are:

Ideal entry price, real entry price, ideal stop, where you actually were filled at for the stop, what your exit strategy is in terms of profit-taking, how far the stock pulled back before returning to the trend (great way to find out if your stop is too tight), what the maximum potential profit of the trade would have been, what time did you enter, what time did you exit, the average volume (use 30 day or 90 day), the relative volume at the time your stock triggered your buy price, et cetera.

Next either with your charting software or simply your OS, take snapshots of the following:

a) the daily chart

b) the intraday chart at time of entry

c) the intraday chart at time of exit -- be it stop or profit

d) the intraday chart at the end of the day

e) the intraday chart at the end of the day in one different time frame (for example if you use 3 minute, take a snapshot of the intraday at 5 minute also)

f) the intraday chart at the end of the day of the market in which the stock trades (so for us, it would be taking a snapshot of the intraday moves of the Nasdaq).

This last part is very important and something that a lot of traders do not do. As the cliche runs, a picture is worth a thousand words, and this could not be more true when it comes to trading. After as few as a dozen trades you will see patterns emerge. For example, you will see that you are correct in finding the trend of a stock but keep getting shaken out because your stops are too tight. Maybe you will realize that the stocks you want to trade have the same intraday pattern as the greater general market, and you realize that it would be more profitable to find a pattern with greater relative strength (or weakness if short) than the general pattern. Most likely you will realize that in the long run it would be more profitable if you were more patient. The review of actual snapshots of your trades coupled with written statistics of the trades offer endless lessons.

Most likely at this point you will feel that the kind of trading that you have chosen might not be the best one for you and you want to experiment with other systems. Repeat steps 1-4.

Don't try to reinvent the wheel. Step on the shoulders of the giants, but do find your own system. Learn from the professionals, tweak their systems, let it evolve, until you find your own way. If you work hard enough, study your mistakes, are constantly self-reflexive and in pursuit of evolving, you too will be able to become a successful, professional trader.

1) First you need exposure to determine what kind of trading interests you. As you will soon find out, there are many ways to earn a living in the market. Do you want to trade hundreds of times a day, exchanging thousands of shares, chasing pennies? Or would you prefer to become a swing or position trader based on daily and weekly chart patterns? Maybe possibly just a day trader looking for intraday gap break-outs? Or somewhere in between, like us, trading off of daily but mostly for day holds, on average trading 1-3 times a day. How do you get this exposure? Read different books, check out websites and blogs of active traders.

2) Find a system that you feel suits your personality. For example, we are methodological traders who like the calmness of trading from a pre-defined list every day. On average there might be only 10 stocks on our Main list to trade from, and those only at exact prices. If these prices are not reached, then no trade. Other traders, for example, live for the chase and the thrill and may only trade stocks which have released news or earnings.

3) Alright now you have honed in on an area of trading that interests you. For the sake of argument, you, like us, prefer to trade only a few times a day, based on daily charts. So now what? Now you read some books related to this type of trading, find specific websites that practice the type of trading you are interested in, and if possible, come into contact with actual traders who practice the type of trading that interests you. What books did we read and do we recommend? Well, they're a mixed bunch but we think that all of them should be read:

How to Make Money in Stocks by William O'Neill

How I made $2,000,000 in the Stock Market by Nicolas Darvas

High Probability Trading by Marcel Link

Encyclopedia of Chart Patterns by Thomas Bulkowski

4) Now you need to get your feet wet. You can start out by paper-trading but probably the best way to really gain experience is to actually jump into the market with real money. However, start small. For example, you have decided to become a break-out trader and have noticed that stock HCPG is close to breaking the downtrend line at 50. The next day HCPG breaks through 50 and you buy it. Start with 100 share trades but treat it as if it were a 1000 share lot. Now write down, be it in a written journal, or an Excel Program, every possible relevant factor. For example some categories are:

Ideal entry price, real entry price, ideal stop, where you actually were filled at for the stop, what your exit strategy is in terms of profit-taking, how far the stock pulled back before returning to the trend (great way to find out if your stop is too tight), what the maximum potential profit of the trade would have been, what time did you enter, what time did you exit, the average volume (use 30 day or 90 day), the relative volume at the time your stock triggered your buy price, et cetera.

Next either with your charting software or simply your OS, take snapshots of the following:

a) the daily chart

b) the intraday chart at time of entry

c) the intraday chart at time of exit -- be it stop or profit

d) the intraday chart at the end of the day

e) the intraday chart at the end of the day in one different time frame (for example if you use 3 minute, take a snapshot of the intraday at 5 minute also)

f) the intraday chart at the end of the day of the market in which the stock trades (so for us, it would be taking a snapshot of the intraday moves of the Nasdaq).

This last part is very important and something that a lot of traders do not do. As the cliche runs, a picture is worth a thousand words, and this could not be more true when it comes to trading. After as few as a dozen trades you will see patterns emerge. For example, you will see that you are correct in finding the trend of a stock but keep getting shaken out because your stops are too tight. Maybe you will realize that the stocks you want to trade have the same intraday pattern as the greater general market, and you realize that it would be more profitable to find a pattern with greater relative strength (or weakness if short) than the general pattern. Most likely you will realize that in the long run it would be more profitable if you were more patient. The review of actual snapshots of your trades coupled with written statistics of the trades offer endless lessons.

Most likely at this point you will feel that the kind of trading that you have chosen might not be the best one for you and you want to experiment with other systems. Repeat steps 1-4.

Don't try to reinvent the wheel. Step on the shoulders of the giants, but do find your own system. Learn from the professionals, tweak their systems, let it evolve, until you find your own way. If you work hard enough, study your mistakes, are constantly self-reflexive and in pursuit of evolving, you too will be able to become a successful, professional trader.

Thursday, August 17, 2006

How opening up our business has helped us become better traders

What has pleased us immensely since we started up our service is the realization that more often than not, when our stock picks are going to go in the opposite direction than the one we hope for, they usually do so BEFORE confirming our picks. For example, we liked WIRE 36.8/37 and AKAM 40.4 from last night-- today they went down several percent, but they behaved well in that they did not first trigger our pick and then go down (therefore of course we did not enter the trades since they did not trigger our prices). We had not realized how "well-behaved" most stocks are until we started keeping statistics for our newsletters.

Opening up this newsletter has helped us also to become better traders. For example, we used to set alerts on many different stocks, including minor buy points and somewhat questionable set-ups. However, once we started writing the newsletter we decided to include only the cleanest, best selections for our readers. We realized after a month or so that our own performance improved by focussing on those same stocks and disregarding the "minor" buy/sell points which were distracting us from the best moves of the day.

Another way the newsletter has helped us is that we now only trade from the lists provided to our subscribers. Most days there will be at least a few good opportunities in the provided selections. The advantage is that you are prepared for the day and you are familiar with the stock, as compared to scanning intraday for a possible set-up and often taking third-rate set-ups just because you were rushed to make a decision. We don't like feeling rushed into entering a position, so trading only from a pre-defined list from the night before is very appealing.

The only stocks we look at during the day are the stocks mentioned in the lists given to our subscribers every night. This might seem "limiting" to some of you but upon closer introspection the numbers will surprise you. For example, if you had ONLY watched our stocks this week (last 4 trading days) and entered a position in each stock that triggered from the trading lists and the watch-list, without regard to volume, intraday set-up, market conditions, et cetera, these would be your day-trade results:

Flat :

ILMN short, PWEI, TRMB

Losses maximum 1%:

GILD, ERTS

Profits minimum 1% to maximum 8%:

GPRO short , CRDN short, RIMM, OXPS,

DIGE, DRIV, FWLT, GROW, PWEI, TZOO

The results are 10 wins ranging from minimum 1% to 8% maximum daytrade profit (depending on where you took profits) versus 2 losses of 1% maximum. We're happy with these results and feel that if you are patient enough to wait for quality set-ups (which means that some days you only trade once or none at all), you can achieve a very respectful win-loss ratio. The more experienced we become in this career (and in life), the more we realize how critical controlling greed and fear is to becoming successful.

Opening up this newsletter has helped us also to become better traders. For example, we used to set alerts on many different stocks, including minor buy points and somewhat questionable set-ups. However, once we started writing the newsletter we decided to include only the cleanest, best selections for our readers. We realized after a month or so that our own performance improved by focussing on those same stocks and disregarding the "minor" buy/sell points which were distracting us from the best moves of the day.

Another way the newsletter has helped us is that we now only trade from the lists provided to our subscribers. Most days there will be at least a few good opportunities in the provided selections. The advantage is that you are prepared for the day and you are familiar with the stock, as compared to scanning intraday for a possible set-up and often taking third-rate set-ups just because you were rushed to make a decision. We don't like feeling rushed into entering a position, so trading only from a pre-defined list from the night before is very appealing.

The only stocks we look at during the day are the stocks mentioned in the lists given to our subscribers every night. This might seem "limiting" to some of you but upon closer introspection the numbers will surprise you. For example, if you had ONLY watched our stocks this week (last 4 trading days) and entered a position in each stock that triggered from the trading lists and the watch-list, without regard to volume, intraday set-up, market conditions, et cetera, these would be your day-trade results:

Flat :

ILMN short, PWEI, TRMB

Losses maximum 1%:

GILD, ERTS

Profits minimum 1% to maximum 8%:

GPRO short , CRDN short, RIMM, OXPS,

DIGE, DRIV, FWLT, GROW, PWEI, TZOO

The results are 10 wins ranging from minimum 1% to 8% maximum daytrade profit (depending on where you took profits) versus 2 losses of 1% maximum. We're happy with these results and feel that if you are patient enough to wait for quality set-ups (which means that some days you only trade once or none at all), you can achieve a very respectful win-loss ratio. The more experienced we become in this career (and in life), the more we realize how critical controlling greed and fear is to becoming successful.

Wednesday, August 09, 2006

How ugly can you get?

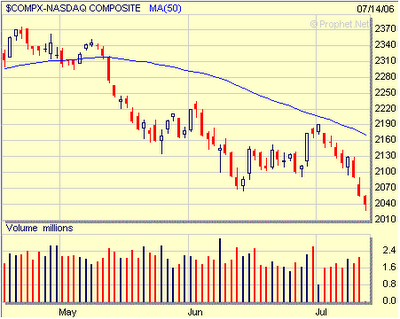

We usually do not discuss indices on our site since as short-term traders we prefer to look at individual set-ups, especially leader stocks whose moves usually precede those of the indices. However, it's difficult to ignore the ugliness of the bearish wedge pattern on the Nasdaq.

What is the most likely scenario? A continuation move to the downside towards the symbolic 2000 number for starters. What would negate this pattern? A move over the 50dma and over 2120 would be a great step in the right direction. But as we have always said, opinions, beliefs, and prophecies should all be left at the doorstep before you enter your office every morning. Within the realm of trading, hope indeed never escaped from Pandora's box. As always, trade the set-ups, and trade with the trend.

What is the most likely scenario? A continuation move to the downside towards the symbolic 2000 number for starters. What would negate this pattern? A move over the 50dma and over 2120 would be a great step in the right direction. But as we have always said, opinions, beliefs, and prophecies should all be left at the doorstep before you enter your office every morning. Within the realm of trading, hope indeed never escaped from Pandora's box. As always, trade the set-ups, and trade with the trend.

Monday, August 07, 2006

Vertical Spikes and Basing

We had placed NIHD short alert at 50 in our weekend newsletter last night along with the following chart indicating to enter a short position on the break of 50 support.

Today, NIHD opened green and proceeded to rally somewhat before reversing hard on heavy volume. She came rushing down from over 51 to hit our alert at 50 and confirm the trade at 49.88. However, this was not the easiest trade to take since, as we have written here numerous times, chasing vertical moves is not a great trading strategy. Let's take a look at the actual trade:

Here comes the vertical move with very heavy volume.

Vertical spikes are rarely worth chasing. If the volume is heavy and the pivot point on the daily very attractive, then watch for a base right above (or below if short) the pivot point. This way you do not have to chase, and you are supplied with a nice entry with a risk defined natural stop.

NIHD is a perfect example of this as she bases right under the pivot point of 50. From there you could easily put on a position short at 49.8 with a 20-25 cent stop (right above 50).

As you see she based there only for a little while before dropping exactly one point for a nice and quick 1 point target daytrade.

At which time you bow your head, say thank you, and take at least a good portion of the daytrade profit. Of course you could argue -- well I chased it short at 50, got in at a better entry than you, and profited just the same, so what is the advantage of letting it base? Remember, trading is a number's game and we have too often seen vertical spikes quickly reverse for a large loss, to ever be interested in chasing a trade. It might work for you once in a while, but in the long run, it pays off to be patient, and wait for the intraday base to give you a defined stop. Wait for the set-up = waiting for the trade to come to you.

Today, NIHD opened green and proceeded to rally somewhat before reversing hard on heavy volume. She came rushing down from over 51 to hit our alert at 50 and confirm the trade at 49.88. However, this was not the easiest trade to take since, as we have written here numerous times, chasing vertical moves is not a great trading strategy. Let's take a look at the actual trade:

Here comes the vertical move with very heavy volume.

Vertical spikes are rarely worth chasing. If the volume is heavy and the pivot point on the daily very attractive, then watch for a base right above (or below if short) the pivot point. This way you do not have to chase, and you are supplied with a nice entry with a risk defined natural stop.

NIHD is a perfect example of this as she bases right under the pivot point of 50. From there you could easily put on a position short at 49.8 with a 20-25 cent stop (right above 50).

As you see she based there only for a little while before dropping exactly one point for a nice and quick 1 point target daytrade.

At which time you bow your head, say thank you, and take at least a good portion of the daytrade profit. Of course you could argue -- well I chased it short at 50, got in at a better entry than you, and profited just the same, so what is the advantage of letting it base? Remember, trading is a number's game and we have too often seen vertical spikes quickly reverse for a large loss, to ever be interested in chasing a trade. It might work for you once in a while, but in the long run, it pays off to be patient, and wait for the intraday base to give you a defined stop. Wait for the set-up = waiting for the trade to come to you.

Saturday, August 05, 2006

Our Links

On the bottom right-hand side of our blog you will find a section called "Blogs we Like". These include blogs that have excellent real-time information about what is happening in the market, such as Knight Trader, The Kirk Report, Maoxian and Trader Mike; blog writers who share their daily journeys (and which include some great wacky personalities)such as Ugly Chart, Trader X, Move the Markets, and Newb Trading ; and others who trade in a similar fashion to us like Bull Trader,

The Wall St. Warrior, and

Downtown Trader. We also have added a great new little service called

Instant Bull which allows you, among other things, to quickly look up relevant information about your stock (information that we like to check, such as earnings date, float information, historical data information), check out news, and peruse 30 excellent blogs in one screen. Check out our links; you'll find them to be useful shortcuts in the dizzying world of online financial information.

Wednesday, August 02, 2006

Three great ways to trade around our numbers

We wanted to discuss today the various ways you can use our entry prices; numbers which are always representative of an important spot, be it resistance, break of downtrend line, etc, and which often act like magnets for stocks.

A: The first and most common way is to simply wait for the set-up, check to see if the intraday conditions are fulfilled, and if affirmative, enter through the confirmation number.

B: The second way, is to do a reverse trade IF the intraday conditions are NOT fulfilled. For example, we list stock HCPG as having formidable resistance at 100. The stock approximates our number in a sloppy way with very light volume and for these reasons you know that there is no way you will buy the stock as there is a high chance of failure. The best trade here would be to short the stock, close to resistance, with a stop right above.

C: The third way is one that is slightly trickier but that often works well. However, we would recommend this only be used for more experienced traders. As you know we often have written that the most successful way to trade is to wait for the daily and intraday charts to coincide. What does this mean? This means that the intraday chart also bases near the listed entry price, thereby also printing a nice pattern. Now, the third way to use our entry prices is as price targets. Sometimes what occurs is that a stock fulfills all the intraday conditions (great volume, relative strength, and basing nicely), BUT is doing all this a few percent away from our listed entry price. The stock then proceeds to break this nice base with good volume. We often are buyers of these breaks, and ride the stocks up in their subsequent vertical moves until the stock actually reaches our own entry price. Usually that is the time to sell most of the position (we keep a little just in case it has enough momentum to go through, however this usually does not happen). Why sell? Because a stock that has just ran a point usually is very low on steam and is not in a position to break resistance. This is the reason we repeatedly tell our readers to never buy on top of a vertical move. Let's use two examples. The first one you will recognize from a UARM trade from a couple weeks ago that we had listed as a buy through 43.5. She based very nicely at 42.6 and then broke the base with volume and ran EXACTLY to 43.5. The second example was from HANS today. We had listed 47 HANS two days ago.

42.6 was an absolute beautiful base in UARM, with a positive break coming with a volume spike. The trade was from the break of the base to resistance at 43.5.

The second example, HANS, based today very nicely at 45.4 with heavy volume and excellent relative strength. The second possible entry was 45.8. The target? Our own listed price of 47 (which was resistance).

Sometimes, especially in low-volume summer trading, momentum trading does not function very well. In these occasions, one can resort to methods B and C more often. However, we should add that if you find all this confusing, no worries, be extra patient, and stick to method A, which is sufficient to earn a good living in the long run.

A: The first and most common way is to simply wait for the set-up, check to see if the intraday conditions are fulfilled, and if affirmative, enter through the confirmation number.

B: The second way, is to do a reverse trade IF the intraday conditions are NOT fulfilled. For example, we list stock HCPG as having formidable resistance at 100. The stock approximates our number in a sloppy way with very light volume and for these reasons you know that there is no way you will buy the stock as there is a high chance of failure. The best trade here would be to short the stock, close to resistance, with a stop right above.

C: The third way is one that is slightly trickier but that often works well. However, we would recommend this only be used for more experienced traders. As you know we often have written that the most successful way to trade is to wait for the daily and intraday charts to coincide. What does this mean? This means that the intraday chart also bases near the listed entry price, thereby also printing a nice pattern. Now, the third way to use our entry prices is as price targets. Sometimes what occurs is that a stock fulfills all the intraday conditions (great volume, relative strength, and basing nicely), BUT is doing all this a few percent away from our listed entry price. The stock then proceeds to break this nice base with good volume. We often are buyers of these breaks, and ride the stocks up in their subsequent vertical moves until the stock actually reaches our own entry price. Usually that is the time to sell most of the position (we keep a little just in case it has enough momentum to go through, however this usually does not happen). Why sell? Because a stock that has just ran a point usually is very low on steam and is not in a position to break resistance. This is the reason we repeatedly tell our readers to never buy on top of a vertical move. Let's use two examples. The first one you will recognize from a UARM trade from a couple weeks ago that we had listed as a buy through 43.5. She based very nicely at 42.6 and then broke the base with volume and ran EXACTLY to 43.5. The second example was from HANS today. We had listed 47 HANS two days ago.

42.6 was an absolute beautiful base in UARM, with a positive break coming with a volume spike. The trade was from the break of the base to resistance at 43.5.

The second example, HANS, based today very nicely at 45.4 with heavy volume and excellent relative strength. The second possible entry was 45.8. The target? Our own listed price of 47 (which was resistance).

Sometimes, especially in low-volume summer trading, momentum trading does not function very well. In these occasions, one can resort to methods B and C more often. However, we should add that if you find all this confusing, no worries, be extra patient, and stick to method A, which is sufficient to earn a good living in the long run.

Saturday, July 29, 2006

The Pleasures of Not Being Spontaneous

There seem to be so many similarities between trading and fighting that it comes as no surprise that traders often resort to martial metaphors. The greatest theoretician of war was the Chinese sage Sun Tzu; and none of his insights from his famous treatise "The Art of War" is better known than his saying that "every battle is won before it is fought". Of course few traders have actually read Sun Tzu; but all of us have heard Gordon Gekko a.k.a. Michael Douglas quote this rule in Wall Street.

What Sun Tzu meant was that several conditions have to be in place before you engage the enemy: make sure that you choose the battleground; arrive before the enemy does; occupy the high ground; do not reveal the strength of your forces; have the right troops at your disposal; do everything to boost your army’s moral and undermine that of your enemy; and choose when and where to attack. All conditions that have to be fulfilled before the battle has begun. (read our Just Trade the Setups Dammit , The sitting

on conditions that have to be met before you enter a position).

All this requires meticulous preparation. Even our emphasis on knowing your stock's behavior fits within this philosophy. If you have worked out everything in advance, victory is more likely. Never trust a general who is surprised by his victory; never trust a trader who is lucky enough to pocket a gain without knowing why.

Like officers who start to improvise on the battlefield, many traders run constant scans during the trading day in order to find trading opportunities, while others hover around in chat rooms waiting/hoping for someone to find a stock with potential. We prefer to prepare our lists the night before and ONLY trade from those particular stocks in our list (the same list that is given to our subscribers every night). Unlike Sun Tzu, however, we do not believe that our method is superior; on-the-spot methods are successfully used by many traders.

However, our method fits very well with our personality. We feel that stress is considerably reduced as we are staring at a limited number of stocks (categorized by how close they are to our possible entry prices) and are not in a need to constantly run scans. We try to avoid a position which forces you to rapidly bring up the daily chart, the 60 minute chart, and try to figure out whether a trade is worth a shot or not, all the while hoping that it does not run away as you are in the decision-making process. Stress-reduction, we feel, is a factor that is critical to a trader's career. At the age of retirement we do not want to feel like we have won a Pyrrhic victory, i.e. having made a good salary at the cost of our health and relationships.

We like to be relaxed during the trading day (think the anti-Cramer: no keyboard throwing, no bruised knuckles, no crashed monitors), if the market acts lackluster and as such our picks are far away from triggering, we can let our guard down, grab a drink, and relax. Well you argue, don’t you miss the big opportunities? Possibly. However, for us, trading is a numbers game. We are not looking for the occasional home-run but rather consistency. We have been traders for 7 years; and fate willing, we shall be doing it for many more years to come. We are not seeking the exhilaration of a Vegas-like environment. Or, to stick to the military domain, we're not trying to come up with sudden ingenious battlefield moves; but rather, to be more like Eisenhower: organize, organize, and organize before you move.

We are seeking the quotidian: Day in, day out, being true to one’s rules of engagement, putting aside our opinions, and trusting our set-ups. In the long run, everything else will fall into place.

What Sun Tzu meant was that several conditions have to be in place before you engage the enemy: make sure that you choose the battleground; arrive before the enemy does; occupy the high ground; do not reveal the strength of your forces; have the right troops at your disposal; do everything to boost your army’s moral and undermine that of your enemy; and choose when and where to attack. All conditions that have to be fulfilled before the battle has begun. (read our Just Trade the Setups Dammit , The sitting

on conditions that have to be met before you enter a position).

All this requires meticulous preparation. Even our emphasis on knowing your stock's behavior fits within this philosophy. If you have worked out everything in advance, victory is more likely. Never trust a general who is surprised by his victory; never trust a trader who is lucky enough to pocket a gain without knowing why.

Like officers who start to improvise on the battlefield, many traders run constant scans during the trading day in order to find trading opportunities, while others hover around in chat rooms waiting/hoping for someone to find a stock with potential. We prefer to prepare our lists the night before and ONLY trade from those particular stocks in our list (the same list that is given to our subscribers every night). Unlike Sun Tzu, however, we do not believe that our method is superior; on-the-spot methods are successfully used by many traders.

However, our method fits very well with our personality. We feel that stress is considerably reduced as we are staring at a limited number of stocks (categorized by how close they are to our possible entry prices) and are not in a need to constantly run scans. We try to avoid a position which forces you to rapidly bring up the daily chart, the 60 minute chart, and try to figure out whether a trade is worth a shot or not, all the while hoping that it does not run away as you are in the decision-making process. Stress-reduction, we feel, is a factor that is critical to a trader's career. At the age of retirement we do not want to feel like we have won a Pyrrhic victory, i.e. having made a good salary at the cost of our health and relationships.

We like to be relaxed during the trading day (think the anti-Cramer: no keyboard throwing, no bruised knuckles, no crashed monitors), if the market acts lackluster and as such our picks are far away from triggering, we can let our guard down, grab a drink, and relax. Well you argue, don’t you miss the big opportunities? Possibly. However, for us, trading is a numbers game. We are not looking for the occasional home-run but rather consistency. We have been traders for 7 years; and fate willing, we shall be doing it for many more years to come. We are not seeking the exhilaration of a Vegas-like environment. Or, to stick to the military domain, we're not trying to come up with sudden ingenious battlefield moves; but rather, to be more like Eisenhower: organize, organize, and organize before you move.

We are seeking the quotidian: Day in, day out, being true to one’s rules of engagement, putting aside our opinions, and trusting our set-ups. In the long run, everything else will fall into place.

Wednesday, July 19, 2006

Getting to know your Friends

Without a doubt one activity that many professional traders share is that they get to know their friends. Stock friends, that is. One of the most valuable things that we have learned over the years is how important it is to become familiar with the behaviour of your stocks. For example, you have been watching stock HCPG for a break of 50 for over a week, 50 representing new highs. For days you have followed the stock approach 50 from different angles, with different volumes, at different times of the day, only for it to be rejected near the buy point. The next day HCPG is sitting at 49.5 in a flattish market. Then, however, you notice the way she starts to climb up towards 50 this time is somehow different -- this time you know that most likely it will successful. How do you know? Because you have become familiar with your friend and you note a behavior change. At some levels it has to be sub-conscious; if a buddy sitting beside you asks what exactly was different, often it's difficult to pin down. But from our own experience, we have no doubt how well it works.

This is the reason that we also place stocks whose patterns are not completely formed or are too far away, in the "secondary list" of our newsletter; so that subscribers can start watching them days before and familiarize themselves with the stock's behavior. It is also the reason we like to stick to a core group of stocks, around 200 of them, instead of scanning each night through a 1500 stocks looking for patterns. As a rule we never trade a stock that we are not familiar with. If there is a new stock that is gaining attention from momentum traders, we immediately add it to our core group of stocks so that it too can become our friend.

This is the reason that we also place stocks whose patterns are not completely formed or are too far away, in the "secondary list" of our newsletter; so that subscribers can start watching them days before and familiarize themselves with the stock's behavior. It is also the reason we like to stick to a core group of stocks, around 200 of them, instead of scanning each night through a 1500 stocks looking for patterns. As a rule we never trade a stock that we are not familiar with. If there is a new stock that is gaining attention from momentum traders, we immediately add it to our core group of stocks so that it too can become our friend.

Sunday, July 16, 2006

Loyalty and Stocks

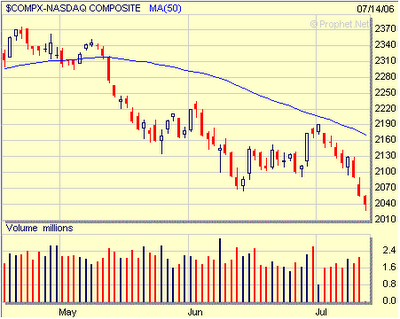

We have often spoken about BIDU to our subscribers in our newsletter. It has held remarkably well for this market. Let's take a look at the Nasdaq and BIDU over the last 3 months to illustrate this point.

This is the reason why we say that BIDU should be on your lists every day. Every year there are a new crop of winners --for example in the last two years there was great action in stocks such as TASR TZOO GOOG AAPL SNDK. All these stocks, with possibly the exception of GOOG, are completely broken now (even though TZOO has found some renewed momentum these last few weeks). Often great winners of last year who could do no wrong, like AAPL SNDK, now could not possibly act any worse. The torch has been passed this year to the new crop of momentum winners, stocks like BIDU GRMN HANS; even though we cannot forget this is bear market action in which we find ourselves, and thus upside momentum has been somewhat absent recently.

Always watch the winners and have a place for them on your list every day. Watch how they act relative to the market. And never get married to previous winners. We are great believers in loyalty -- loyalty to our families, friends, and to our nations; but this great quality in life has absolutely no place in trading. By next year we will have new winner stocks to watch every day and most likely have short positions on this year's winners. The only loyalty we have in trading are to chart patterns and to our own rules of engagement. Everything else is just a ticker -- 4 letters that can represent a profit or a loss.

This is the reason why we say that BIDU should be on your lists every day. Every year there are a new crop of winners --for example in the last two years there was great action in stocks such as TASR TZOO GOOG AAPL SNDK. All these stocks, with possibly the exception of GOOG, are completely broken now (even though TZOO has found some renewed momentum these last few weeks). Often great winners of last year who could do no wrong, like AAPL SNDK, now could not possibly act any worse. The torch has been passed this year to the new crop of momentum winners, stocks like BIDU GRMN HANS; even though we cannot forget this is bear market action in which we find ourselves, and thus upside momentum has been somewhat absent recently.

Always watch the winners and have a place for them on your list every day. Watch how they act relative to the market. And never get married to previous winners. We are great believers in loyalty -- loyalty to our families, friends, and to our nations; but this great quality in life has absolutely no place in trading. By next year we will have new winner stocks to watch every day and most likely have short positions on this year's winners. The only loyalty we have in trading are to chart patterns and to our own rules of engagement. Everything else is just a ticker -- 4 letters that can represent a profit or a loss.

Wednesday, July 12, 2006

The importance of Volume

We cannot emphasize enough the importance of volume in trading stocks based on chart patterns. Most trading programs have a volume percentage tool which tells you at any given moment what percentage of volume a stock is trading in relation to its average volume (usually based on 30 day and 90 day averages). For example, let's say stock HCPG has been trading 1 million shares on average for the last 3 months. That means by the end of the day, the volume % indicator will most likely be near 100%. Now imagine HCPG is forming a very nice base under her trendline that triggers through a break of 50. The market opens and you notice that your stock is getting very close to 50 and that the volume indicator is reading 25% at 9:45 AM. That means that she has traded 25% of her entire day's volume already in the first 15 minutes of trading. Be interested. Be very interested.

If you do not have a volume percent tool you might want to check out some of the more popular trading programs. We recommend

QuoteTracker as it is will give you a very good idea of how to use this tool, and to top it off, it's free.

If you do not have a volume percent tool you might want to check out some of the more popular trading programs. We recommend

QuoteTracker as it is will give you a very good idea of how to use this tool, and to top it off, it's free.

Saturday, July 08, 2006

Why did we create the Highchartpatterns Group?

There are many reasons but all belong to the categories of self-interested and altruistic. Let's start with self-interest. First, the act of writing lends clarity and coherence to one's thoughts as it forces you to think over what you are doing. This is something we have come to realize even more strongly since we started this service. We have consistently strived to trade in an orderly, clear and disciplined manner. Articulating and putting down our rules, printing out charts, and commenting on patterns for the next day has made us into more focussed traders. In a way, parts of it are like an enhanced trading journal (which, by the way, we recommend to all).

We decided to charge just so much as to be motivated to keep doing such a service (if it were for free we are sure we would not feel pressured enough to update it on a daily basis) but not so much that it becomes too expensive for traders who are starting out, or for people who subscribe to multiple services who do not want to add another $150 a month to their bills. $30 a pop sounded just right. Having it so inexpensive also means that trading will always be the main source of income for us, since as soon as you stop trading and become an observer, you lose the trader's edge: that instinct of looking at a stock's price action and seeing it set up even before the pattern has emerged on the daily chart.

As for the altruistic reasons there is only one -- we were helped by others when we started; now it's our turn to give back.

We decided to charge just so much as to be motivated to keep doing such a service (if it were for free we are sure we would not feel pressured enough to update it on a daily basis) but not so much that it becomes too expensive for traders who are starting out, or for people who subscribe to multiple services who do not want to add another $150 a month to their bills. $30 a pop sounded just right. Having it so inexpensive also means that trading will always be the main source of income for us, since as soon as you stop trading and become an observer, you lose the trader's edge: that instinct of looking at a stock's price action and seeing it set up even before the pattern has emerged on the daily chart.

As for the altruistic reasons there is only one -- we were helped by others when we started; now it's our turn to give back.

Friday, July 07, 2006

Trust Yourself

One of the most important and difficult things to learn as a trader is simply to trust yourself. By this we do not mean that you should be stubborn when a position goes against you, or heaven forbid, average down, Once you enter a trade then all opinions, feelings, instincts, et cetera, must defer to simple risk management and profit-taking rules. What we mean by "trust yourself" is something that is critical BEFORE you enter a trade.

Last night, we went through the charts of our favorite momentum stocks and saw absolutely nothing we liked, thus we did not post a single stock in our Main list. Now this happens only 1-2 times a month, hence it is not a common occurrence. Today the market hurt a lot of bulls and a lot of bears and most likely it would have resulted in losses for any positions that we would have entered with our particular system. So was it a coincidence? We doubt it, since we have seen it happen too often. When you are doing your preparation work for the next day and nothing jumps out – be it longs or shorts– know that most likely the next day will be a very difficult one.

Let's look at another example: Every day, we have a main list of stocks with specific entry prices that we watch. Sometimes we find ourselves in a situation where none of these stocks on our list are close the triggering but the market suddenly spikes and looks like it’s going to rally 50 points. We get nervous and think – what shall we do – the market is going to rally and we have nothing in our list to trade (we only trade stocks from our list prepared the night before, and shared with our subscribers). More often than not, that initial move is nothing but a bull trap and the market reverses. In our experience, we have found that if a market move is for real, i.e. lasting, then you will already have setups prepared from the night before that will trigger once the market makes a move. Chart patterns are nothing but footprints of the greenbacks, and they will rarely let you down. Trust the set ups, trust yourself, obey your rules of risk management and profit taking, and in the long run everything else will fall into place.

Last night, we went through the charts of our favorite momentum stocks and saw absolutely nothing we liked, thus we did not post a single stock in our Main list. Now this happens only 1-2 times a month, hence it is not a common occurrence. Today the market hurt a lot of bulls and a lot of bears and most likely it would have resulted in losses for any positions that we would have entered with our particular system. So was it a coincidence? We doubt it, since we have seen it happen too often. When you are doing your preparation work for the next day and nothing jumps out – be it longs or shorts– know that most likely the next day will be a very difficult one.

Let's look at another example: Every day, we have a main list of stocks with specific entry prices that we watch. Sometimes we find ourselves in a situation where none of these stocks on our list are close the triggering but the market suddenly spikes and looks like it’s going to rally 50 points. We get nervous and think – what shall we do – the market is going to rally and we have nothing in our list to trade (we only trade stocks from our list prepared the night before, and shared with our subscribers). More often than not, that initial move is nothing but a bull trap and the market reverses. In our experience, we have found that if a market move is for real, i.e. lasting, then you will already have setups prepared from the night before that will trigger once the market makes a move. Chart patterns are nothing but footprints of the greenbacks, and they will rarely let you down. Trust the set ups, trust yourself, obey your rules of risk management and profit taking, and in the long run everything else will fall into place.

Thursday, June 29, 2006

Just trade the setups, Dammit!

Caution: This advice only pertains to short-term trading and not longer-term investing, swing trading, position trading, etc.

We do not open our newsletters with charts of the Nasdaq, S&P, VIX, discussion of Stochastics, etc., not because we are too lazy but rather because we think it is counterproductive to analyze such matters for the type of trading that we practice.* The more you study the indices and attempt to interpret the stream of information that the plethora of indicators offer, the more you will form an opinion before the market even opens. We follow the leaders of the market and the leaders of the market are usually on the avante-garde of market moves. The leaders will signal when a bottom has formed or when a correction is due. In addition to the leader stocks we watch a host of momentum stocks which are often also great early tells for market moves.

There is a very important reason that we have told our clients in our newsletters-- leave your opinions and emotions at the door before entering your office in the morning. Emotions are the enemy of the trader. Most traders will have heard of the story that if a man sits in front of a great trader and watches him all day, he will not know at the end of the day whether the man made a million dollars or lost a million dollars.

The best traders just simply react to the circumstances. For example -- stock HCPG is approaching the price at which you would like to buy it based on a break of a 2 month consolidation.

Above Average Volume? Check

Is the Trend with you? Check

Is the stock showing greater relative strength than the market? Check

Is the intraday nice and tight without big volatile spikes up and down? Check

Is the breakout coming off of an intraday base instead of a chase of a vertical move which is to be avoided? Check

Trade entered. After that you obey your risk management and profit taking rules for the remainder of the trade. Many traders miss out on great opportunities because they think that the market is too overbought or oversold. Just trade the setups. That's it. When the market finally does decide to turn there will be ample signs and new setups will emerge in the correct direction.

* Usually we aim for 1-3% profits on daytrades and occasionally hold positions 1-2 days. We trade on average probably 1-3x a day, all depending on available setups.

We do not open our newsletters with charts of the Nasdaq, S&P, VIX, discussion of Stochastics, etc., not because we are too lazy but rather because we think it is counterproductive to analyze such matters for the type of trading that we practice.* The more you study the indices and attempt to interpret the stream of information that the plethora of indicators offer, the more you will form an opinion before the market even opens. We follow the leaders of the market and the leaders of the market are usually on the avante-garde of market moves. The leaders will signal when a bottom has formed or when a correction is due. In addition to the leader stocks we watch a host of momentum stocks which are often also great early tells for market moves.

There is a very important reason that we have told our clients in our newsletters-- leave your opinions and emotions at the door before entering your office in the morning. Emotions are the enemy of the trader. Most traders will have heard of the story that if a man sits in front of a great trader and watches him all day, he will not know at the end of the day whether the man made a million dollars or lost a million dollars.

The best traders just simply react to the circumstances. For example -- stock HCPG is approaching the price at which you would like to buy it based on a break of a 2 month consolidation.

Above Average Volume? Check

Is the Trend with you? Check

Is the stock showing greater relative strength than the market? Check

Is the intraday nice and tight without big volatile spikes up and down? Check

Is the breakout coming off of an intraday base instead of a chase of a vertical move which is to be avoided? Check

Trade entered. After that you obey your risk management and profit taking rules for the remainder of the trade. Many traders miss out on great opportunities because they think that the market is too overbought or oversold. Just trade the setups. That's it. When the market finally does decide to turn there will be ample signs and new setups will emerge in the correct direction.

* Usually we aim for 1-3% profits on daytrades and occasionally hold positions 1-2 days. We trade on average probably 1-3x a day, all depending on available setups.

The sitting

Jesse Livermore said it well in the now much-quoted, “It never was my thinking that made the big money for me. It always was my sitting.” He was referring to entering a position, and then sitting on it for possibly months at a time. We as short term traders like to decontextualize the quote and place it within our own reality : It’s the sitting, the waiting for that perfect setup, that makes us the consistent money. Waiting for a setup that meets all your conditions is the most important and the most difficult thing we have learnt from our years of trading.

Saturday, June 24, 2006

Chart Patterns and Indicators

There are hundreds of indicators that one can use to interpret stock behavior. We stick to price, volume, and action. We also like to know where the 9, 20,50, 100, and 200DMA are within a chart pattern, as they often are useful as levels of support and resistance.

Everything else we believe is secondary.

Everything else we believe is secondary.

Finding a System

It takes approximately five minutes of perusing trading forums and doing simple searches in Google to realize that there are literally thousands of ways that traders make money in the market. Many systems appear to work as there are many traders who make a good living.

What we would recommend for a person who is just beginning to enter the trading world is to read and research these systems and see what approach they feel most drawn to. The next step unfortunately is the most painful one, and that is the trial and error stage. To form a system for oneself can only come from some hardship. However as time progresses, and if the individual is sufficiently self-reflexive, then a manangable system emerges that not only functions well as a career but that fits the personality of the trader.

As for the thousands of ways to make a living in this business -- they all seem to have several things in common. One has to be self-critical and to constantly try to learn from one's trades -- the winners and the losers. We would recommend a trading journal to aid in this effort. Second, one has to control one's emotions and never ever lose one's discipline. Discipline is the thin blue line between becoming a great trader or washing out, as do the overwhelming majority of people who enter this career.

Trading is like any other job -- you need to work hard, do your homework, and at all times, act like a disciplined professional.

What we would recommend for a person who is just beginning to enter the trading world is to read and research these systems and see what approach they feel most drawn to. The next step unfortunately is the most painful one, and that is the trial and error stage. To form a system for oneself can only come from some hardship. However as time progresses, and if the individual is sufficiently self-reflexive, then a manangable system emerges that not only functions well as a career but that fits the personality of the trader.

As for the thousands of ways to make a living in this business -- they all seem to have several things in common. One has to be self-critical and to constantly try to learn from one's trades -- the winners and the losers. We would recommend a trading journal to aid in this effort. Second, one has to control one's emotions and never ever lose one's discipline. Discipline is the thin blue line between becoming a great trader or washing out, as do the overwhelming majority of people who enter this career.

Trading is like any other job -- you need to work hard, do your homework, and at all times, act like a disciplined professional.

The Psychology of Trading: Rules which we live by

1. When you feel most frustrated at missing moves, you are most vulnerable to losing money and trading in a self-destructive manner (hereon called "trading on tilt" to quote Charles Kirk from The Kirk Report). Do not let it play with your head. Every trade is fresh.

2. Do not overthink or get spooked – stay as close to neutral as possible. Don’t predecide anything, just look for your conditions to be met. Calmness is everything in this profession – in the technical setup system itself and in your own emotions.

3.Remember many big losses have come after innocent small initial losses, and then from attempts to make up that loss and frustration – that is when one forces trades -- lousy setups with no volume, chasing spikes or even worse, following other people’s trades.

4. If you get stopped out and are feeling frustrated then market most likely is in a no win mode – step aside and start fresh next day. Emotion is key. There are some days where it is very difficult to make money.

5. Remind yourself how difficult it is to make money and how incredibly easy it is to lose money. There has to be a reason for every trade.

6. Have Vision -- many times stocks sit there for HOURS ABOVE the entry point– remain in the trade as long as the breakout point is held and then hold for the angle change (as buyers pile in) into real profits.

7. Be on your toes with opens in which you miss several quick trades. Do not go tilt. Many tilt days come from opens that one has missed. Just regroup and try again. If stocks are going up or down in a hyberpolic fashion, there is high chance of reversal. If the move indeed is for real then there will be plenty of opportunities later in the day. Remember that. Just wait for the pitch.

8. On a deeper note -- be at peace with yourself. If you feel like you do not deserve to do well, then most likely you will not do well. Do good, treat your body well, work hard, and everything else will fall into place

2. Do not overthink or get spooked – stay as close to neutral as possible. Don’t predecide anything, just look for your conditions to be met. Calmness is everything in this profession – in the technical setup system itself and in your own emotions.

3.Remember many big losses have come after innocent small initial losses, and then from attempts to make up that loss and frustration – that is when one forces trades -- lousy setups with no volume, chasing spikes or even worse, following other people’s trades.

4. If you get stopped out and are feeling frustrated then market most likely is in a no win mode – step aside and start fresh next day. Emotion is key. There are some days where it is very difficult to make money.

5. Remind yourself how difficult it is to make money and how incredibly easy it is to lose money. There has to be a reason for every trade.

6. Have Vision -- many times stocks sit there for HOURS ABOVE the entry point– remain in the trade as long as the breakout point is held and then hold for the angle change (as buyers pile in) into real profits.

7. Be on your toes with opens in which you miss several quick trades. Do not go tilt. Many tilt days come from opens that one has missed. Just regroup and try again. If stocks are going up or down in a hyberpolic fashion, there is high chance of reversal. If the move indeed is for real then there will be plenty of opportunities later in the day. Remember that. Just wait for the pitch.

8. On a deeper note -- be at peace with yourself. If you feel like you do not deserve to do well, then most likely you will not do well. Do good, treat your body well, work hard, and everything else will fall into place

Free Trial

Sign up for a Free Trial at our service www.highchartpatterns.com

No credit card required, no obligation.

No credit card required, no obligation.

Subscribe to:

Comments (Atom)