China has issued what amounts to the “Beijing Put” on gold. You can make a lot of money, but you really can’t lose.

I happened to see quite a bit of Cheng Siwei at the Ambrosetti Workshop, a gathering of politicians and global strategists at Lake Como, including a dinner at Villa d’Este last night at which he listened very attentively as a number of American guests tore President Obama’s economic and health policy to shreds.

Mr Cheng was until recently Vice-Chairman of the Communist Party’s Standing Committee, and is now a sort of economic ambassador for China around the world — a charming man, by the way, who left Hong Kong for mainland China in 1950 at the age of 16, as young idealist eager to serve the revolution. Sixty years later, he calls himself simply “a survivior”.

What he said about US monetary policy and gold – this bit on the record – would appear to validate the long-held belief of gold bugs that China has fundamentally lost confidence in the US dollar and is going to shift to a partial gold standard through reserve accumulation.

He played down other metals such as copper, saying that they could not double as a proxy currency or store of wealth.

“Gold is definitely an alternative, but when we buy, the price goes up. We have to do it carefully so as not stimulate the market,” he said.

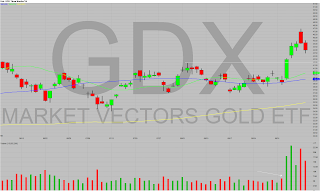

In other words, China is buying the dips, and will continue to do so as a systematic policy. His comment captures exactly what observation of gold price action suggests is happening. Every time it looks as if the bullion market is going to buckle, some big force steps in from the unknown.

Investors long-suspected that it was China. We later discovered that Beijing had in fact doubled its gold reserves to 1054 tonnes. Fait accompli first. Announcement long after.

Standing back, you can see that the steady rise in gold over the last eight years to $994 an ounce last week – outperforming US equities fourfold, even with reinvested dividends – has roughly tracked the emergence of China as a superpower in foreign reserve holdings (now $2 trillion).

As I have written in today’s paper, Mr Cheng (and Beijing) takes a dim view of Ben Bernanke’s monetary experiments at the Federal Reserve.

“If they keep printing money to buy bonds it will lead to inflation, and after a year or two the dollar will fall hard. Most of our foreign reserves are in US bonds and this is very difficult to change, so we will diversify incremental reserves into euros, yen, and other currencies,” he said.

This line of argument is by now well-known. Less understood is how much trouble the Fed’s QE policies are causing in China itself, where they have vicariously set off a speculative boom on the Shanghai exchange and in property. Mr Cheng said mid-level house prices are now ten times incomes.

“If we raise interest rates, we will be flooded with hot money. We have to wait for them. If they raise, we raise.”

“Credit in China is too loose. We have a bubble in the housing market and in stocks so we have to be very careful, because this could fall down.”

Of course, China cold end this problem by letting the yuan rise to its proper value, but China too is trapped. Wafer-thin profit margins on exports mean that vast chunks of Chinese industry would go bust if the yuan rose enough to close the trade surplus. China’s exports were down 23pc in July from a year before even at the current exchange rate, and exports make up 40pc of GDP. “We have lost 20m jobs in this crisis,” he said.

China’s mercantilist export strategy has led the country into a cul-de-sac. China must continue to run its trade surplus. It must accumulate hundreds of billions more in reserves. Ergo, it must buy a great deal more gold.

Where is the gold going to come from?