An educational blog which supplements subscriber service Chart Patterns are nothing but Footprints of the Greenbacks.

Saturday, January 26, 2008

WallStrip

Say what you want about the man, but this is an entertaining interview, and he comes across as funny and honest. He seems to be missing that filter normal people have between what is thought and what is said (short WallStrip?) but that's also what makes him come across as refreshingly direct.

We find it somewhat amusing how much bad press this man receives and somehow, perversely, that motivates us, in turn, to give him some good press. Sure he's into self-promotion, but that's his gig. No reason to hate. Anyway, he won a place on our blog (and no, we don't trade nor have any interest in trading penny stocks).

Thursday, January 24, 2008

The Ultimate Blow-out

Our guess is that on Jan 30, the Fed will still cut 25-50 points, only if to save face.

-------------------------

"Separately, the U.S. Federal Reserve remains comfortable with its decision to cut interest rates Tuesday in spite of news today that the preceding stock selloff may have been related to a rogue trader, a Fed official said. The official said the Fed didn't know of Société Générale's unwinding of positions when it cut rates. Nonetheless, the Fed remains as comfortable now with its decision as it was Monday night, when it was made, the official said."

Source: WSJ

Wednesday, January 23, 2008

Update

There are very few good looking longs going into tomorrow, and we'll be looking at very minor spots (30 min also instead of daily) in order to find something for our members.

QQQQ

We were looking for a 20% hair-cut earlier in Jan and we're almost there in Nas 100.

And to conclude, the Fed is an idiot.

Tuesday, January 22, 2008

Why the Fed needs a Technical Advisor

Nevertheless, the market is holding well but we've still got 90 minutes to go.... we'll see how they close this pig. Any close around this area (Dow down 150 points) would be relatively bullish. Absolute nightmare scenario for the bulls would be a close on the lows.

And yes, we bought our 3rd installment of Nasdaq calls this morning. As stated before this is not how we trade, and it's a very small bet. Our buy today is very green, but two buys from last week are very red. We'll see how it goes.... even though losing it all wouldn't be a bad thing either to teach us to stick to what we know best. Short weakness, buy Strength (unless at key support/resistance level in oversold/overbought markets).

Wednesday, January 16, 2008

Cautionary Note

If the leader stocks get out of their misery and start showing some green, we would instead add to the position today (since it would give better confirmation of a true bottom) If the Nasdaq closes well but momentum stocks close red, then be prepared for further weakness.

As we write this every single solar and Ag stock we follow (plus AAPL GOOG BIDU RIMM) is deeply red while the Dow has gone green.

Friday, January 11, 2008

Market Talk

The next scenario is more painful -- a grind down with small intraday rallies that are constantly sold for weeks on end.

Either way, stay smart and wait for a meaningful reversal before going long. Never underestimate the power of the swing of the pendulum.

Wednesday, January 09, 2008

Market Talk

Tuesday, January 08, 2008

Market Talk

We should be getting some kind of relief rally soon, but for those of you tempted to buy longer term holds.... look at the following chart and imagine this was the chart of a stock for which you had interest:

You'd say "No thanks". This is one bad-ass ugly chart. However, for shorter term bottom lovers, the sell-off has been fast and furious and some kind of rally will be coming. There will be many temporary tradable bottoms coming up (and one should come relatively soon) within what we believe will be a much larger bear trend.

Here is a weekly chart of the Nasdaq -- as you can see we'll be hitting the trend-line soon and should find some support in that zone. However, it's hard for us to believe that the trendline will hold. Gun to head, we're guessing 2008 is going to be the year of the Bears.

Do you remember back in the bear market 2001-2002 so many were waiting for the one event to help the market? "They're going to catch Osama soon," one would hear. Historically, it hasn't been too smart to wait for some event (Osama, Fed) to save the market. It's going to be a deep, painful process that will probably go on for a while. Of course, hopefully we're wrong and the market ends +20% this year instead of the -20% we're predicting.

As always, this is just fun talk. We're short-term traders and will go with the trend, not our opinion. If the charts point long, we'll go long. But most likely, they're going to point short short short for a long time coming. Having said all that, we must add that we make much more money in a bull market than we do in a bear market (our type of momentum trading works much better in a bull market) so we hope that we are completely and utterly wrong!

Friday, November 16, 2007

Excerpt from this weekend's newsletter

Ideal entry was on the base and break lift-off with volume from 194 with fills around 195 or up to even 195.5 (with a 1 point or less stop -- at this point she either had to go immediately or would have been sold-off).

Notice how FSLR gapped up but stopped just under the previous day's high. A gap-up and basing under the previous day's high, with a daily number above and good volume and relative strength all constitute the stock communicating to you her intentions of wanting to make a serious run. We actually made a mistake in her because we were too eager. We were so sure about FSLR making a run that we bought her early before the breakout (193.5) and were later stopped out. It wasn't too smart but at least the second time we were patient and bought her on the base and break. This is a common mistake -- when one really wants in a stock one often jumps the gun. Instead (and here we are also repeating the lesson to ourselves) be patient and wait for the set-up.

Thursday, October 11, 2007

Have Vision

As we have written in the past, our preferred time-frame is the 3 minute chart. We like using the 3 minute time-frame because we feel that it’s easier to spot volume spikes and base and break patterns than in longer time-frames. However, what is sometimes quite difficult, even after you have traded for years, is to see beyond the next tick, and having such a fast time-frame can sometimes make one too focussed on the immediate future. This is the reason we like having the 10day / 30 minute chart and a 3 month daily chart synched with the main 3 minute chart. Therefore, every time we switch the 3 minute chart to another stock, all charts change over. Nothing beats the 3 min chart for entry, but having the daily chart beside you reminds you of the bigger picture.

Sometimes, for specific reasons, you believe a stock will go in a certain direction. However, you can find no decent entry point (i.e. there is no base or any familiar pattern). What do you do? Have vision. Find a spot, enter fewer shares (due to wider stop), set a reasonable stop, and just leave the trade alone. More often than not, these are the most successful, most satisfying trades of them all. First, it’s a very good feeling having a plan and seeing it through. And second, it keeps you from overtrading.

One of the most important stages of the evolution of the trader is from the gung-ho newbie who just shoots and blasts away constantly during the day, and the more contemplative experienced trader who sits on the trade and lets the trade unfold towards the target.

Wednesday, October 10, 2007

Spreading the Love

Downtown Trader, as always, offers good chart commentary on a nightly basis. We like going through his charts because he has a somewhat different style than we do -- and we find the exposure to his method educational.

A lot of stocks we like to trade are actually IBD stocks (explosive earnings growth + sector leadership = momentum). Check out StockBee's site; he often has insightful articles about the IBD method, including this one.

Keep an eye on KnightTrader during the day; they have a great eye for what's moving and when new issues pop-up on the radar, they often appear on the site.

The new Timothy Sykes site has an excellent list of blogs worth exploring.

22dollars often has smart commentary/insight. We're hoping the author will update the site more frequently (but who are we to say that as we have been quite lazy with updating our own blog for a long time now).

Two excellent swing-trade sites are The Market Speculator and Chris Perruna; both traders use daily charts and are often involved in the same stocks we are, but with longer time-frames.

Monday, September 17, 2007

R's and $

We find the R/$ debate irrelevant -- both are important and new traders should log everything (and experienced traders should go back to logging everything when they make changes to their trading methodology). Who said you need to choose one over the other?

As an aside, we are going slightly stir-crazy with the lack of volume/set-ups in the market ... if any of you are feeling similar emotions, just know that we're in the same boat. Let's hope that with the FOMC meeting out of the way within 24hrs, trading will become more interesting.

Thursday, August 16, 2007

Market Talk

A couple of things to notice:

1. Even with all this selling, look how much they are up for the year!

2. It is going to take a long, long time to undo the damage of just these last 3 weeks of selling.

3. No real prediction other than when we see this kind of panic selling, usually it means we are at least close to a short term bottom. All we would be looking for at this point is a dead-cat bounce.

4. If you're a long-term investor just itching to pick up some beaten up names, our advice would be to start picking out some spots, but to not use much ammunition. These kind of down moves rarely end so quickly and we could be in for much more pain before this is over.

Saturday, August 11, 2007

To all those starting out

There are days we can’t find absolutely anything to trade. No set-ups, no opportunities, just nothing. Other traders like us (break-out traders) usually find themselves in a similar situation. But then on that same day there are thousands of traders who find lots of opportunities, many who have great days and even some who have their best day ever. We’ve always said – there are literally thousands of different ways to make money in the stock market, pick one, and respect others. We love break-out trading; for us, it’s perfect, stress level is low (since the numbers come from the night before there’s no real-time pressure to find candidates), there are strict rules to function within (thus less emotional and small draw-downs) and circumscribed risk parameters (to avoid blow-ups). However, we know that some people find it too boring and prefer to find dozens or hundreds of intraday opportunities (scalpers) and who make a very good living from it. Others make their living swing-trading. Others swear by futures. In the end all that counts is whether you can earn a living from trading, that is, whether you can make consistent money from trading.

So how do you find a system that will make you consistent money? The only real answer is trial and error. Start small (give yourself a lot of room for error) and ask yourself what attracts you. Do you prefer to trade actively and make consistent scalps, taking fast money? (And yes, scalpers can make a hell of a lot of money: like anything else, profits add up very fast if you’re a good). If so, then just start reading about the subject, go to blogs where successful scalpers share their techniques: Richard and his host of writers have excellent information and videos at Move the Market.

Do you prefer to do your homework from the night (via daily charts) before or at least combine that with intraday scans? Then go read about how Jamie, Ugly, Tyro, TraderMike, Dave at StockTickr, and Bubs trade.

Do you prefer swing-trading? Spend some time with Chris Perruna, Kirk Report, Market Speculator, Taz Trader, Knight Trader, DownTown Trader, Stock Bee, Pinoy Trader, and Bull Trader.

Most likely none of these sites will give you exactly what you are looking for but they will give you different ideas about the different kinds of trading systems out there. See what attracts you (for example, you might love to add a bunch of technical indicators to your charts, or you might love to trade with paint bars) and then research it some more via books and forums. Should you join a service or subscribe to a newsletter? Possibly, as long as it is inexpensive, it might be a good way to expose you to different systems (for example if you want to do futures, then signing up for a service for a few months to learn from the moderators wouldn’t be a bad idea, as long as they charge a reasonable fee, which to us is anything under $100 a month). But do not sign up for the $5000 options course, or pay $800 a month for a service, or $2000 for a set of CDs. That money could be much better spent learning in the market itself.

Then slowly get your feet wet by starting with very small positions while at the same time keeping meticulous notes on your trades (StockTickr would come in very handy at this point). You will start to learn very fast at this point, (while still possibly losing money – that’s normal. Very few people start making money right from the start). You’ll learn what you can handle, and most importantly, what you can’t. From there it’s a slow learning curve ahead and with the right amount of discipline and work, in our opinion, trading is just like any other job, and most people can make a living out of it if they put in the hours, the sweat, and the blood (with the exception of people who just don’t have the temperament for it, be it lack of discipline, or no control over their emotions, even though we would argue that even these people could change if they wanted to enough).

You might blow through your initial account but slowly your consistency will improve and maybe a year after that you'll start eeking out some profits and be on your way to becoming a professional trader (and if you don't want to call yourself a trader, just call yourself a market liquidity provider). Within the first years there will be times when you feel depressed, unlucky, when you will question yourself, that's all normal and part of the process. Stay grounded, man up, and good luck.

Thursday, July 26, 2007

Excerpt from today's newsletter

Having said that, there was some good action on earnings/news on leader stocks such as AAPL BIDU RVBD CMI. In our own personal trading we are taking profits fast, especially on the long side (a bit too fast as we left almost a point in CROX on the table!) and if something goes against us, we get out a.s.a.p. A gap-down opening and some more panic selling could be a short-term capitulation move that could possibly last for at least a few days.

Monday, June 25, 2007

Link

Click on this link to go to the interview on Wall St Radio

Link

Click on this link to go to the interview on Wall St Radio

Friday, May 25, 2007

Excerpt from today's newsletter

Monday, April 16, 2007

Base and Break Pattern Illustrated

We listed CROX at 54 this weekend on our Forming List (this means that it had a potential trading spot at 54 on the daily chart).

Today it set-up in a very nice base and break pattern 10 cents below the pivot point of 54. We always tell our members that one of the absolute most important elements to becoming a successful trader is to keep your losses small. The base and break pattern by definition has very tight stops. In the following example, one would buy on the break of 53.9 (and the accompanying volume expansion -- remember you want overall high volume PLUS volume expansion at the key breaking point) with a stop at any reversal back into the base -- basically 53.85. This means that most likely you would have filled at 53.92-53.95 and would have had a stop under 10 cents. The target was a 1+% quick trade, meaning that your reward (50 cents +) greatly outweighs your risk (10 cents).

Saturday, March 31, 2007

Base and Break Pattern

The basic point of the pattern is this: most traders trade either off the daily chart, 2-10 day chart, or from intraday patterns. What we realized some years ago was that we could increase our win rate by combining the daily and the intraday chart: this means that we trade the daily numbers, but only if the intraday also sets-up in a recognizable pattern. The base and break pattern is simply a type of consolidation-break pattern (with a number of key nuances in regards to for example how a stock approaches the top of the base before break-out) that we spotted some years ago and which we have been working on especially in the last few years .

We realized that it has a very high win rate when combined with a daily pivot and volume and have been attempting to perfect it ever since. A good number of traders use some form of consolidation break pattern for trading, and some traders use similar patterns simply on an intraday level with no regard to the daily chart -- we don't really recommend this but once in a while, especially in gap-up situations, the set-up and volume are so overwhelming, that it's worth a try -- however, for us, these are rare cases (probably once a month).

As always, there are literally thousands of ways to make money in the market and we have respect for all of them. As a new trader what you have to do is to find a system with which you have found success and which seems to fit your personality and then start the process of making the system yours. This is exactly what we did with break-out trading -- a system that has been around as long as the market has-- we started working with it, adapting it, and slowly changing it until we molded it into something that we felt was ours.

Wednesday, March 28, 2007

Theory versus Execution

He wrote to us today about a trade he took. He was very upset because he didn't follow the rules he knew so well and froze when the stock hit his mental stop and kept diving and diving. Finally, he couldn't stand it anymore and sold near the low of the day, just before the stock bounced again. How many of us have done that early in our career? We'd venture to say all of us.

His entry was excellent -- it was off a stock with a good daily chart, from a solid pattern, and the stock was printing decent volume at the time. However, and this has been happening often in this market, the volume on the break of the intraday consolidation did not come through, as the buyers were just not interested. His original stop was around a dime, and the stock went up a dime before it reversed -- at that time his stop should have been moved up (and he knows that) for a loss of probably a nickel -- very small to say the least. His exit though -- now that's the problem. Have you ever noticed that often the times that you blow your stop are on trades that immediately reverse? It seems to be much easier to obey a stop on a stock has been above the number for a few hours or even 30 minutes, but when a stock reverses on one immediately-- that's the most dangerous time and new traders can often find themselves just watching the stock go through the stop and not pushing the sell button. There's something about losing money instantly that is especially irritating, like you didn't even get your money's worth out of the trade, not even any entertainment value! Awareness is everything and if you are aware that your weakness is not obeying your stops on trades that immediately reverse, you can tell yourself that before every trade -- OK, sometimes I freeze on immediate reversals, I know this, and I'm going to make sure it doesn't happen. This, in our opinion, is the best solution for this problem. Awareness of the problem, and recognition of this before entry of every trade (especially in markets like this which are not particularly favorable to momentum trading).

This kid, N.S., knows the theory very well -- and he has soaked up everything we have taught him. But the execution takes a long time to master -- the reason we have faith in him is that he learns from every mistake. We told him today that once you enter a position, then stop thinking. You know where the potential profit exit and the stop are before you enter, you know what to look for, and you know what to do. From here on, you're a machine. It's not easy, but we are firm believers that anyone who is willing to learn, and has true discipline and dedication, can become a good, consistent, professional trader.

Monday, February 12, 2007

Four Categories of Trading

There are literally thousands of ways to make money in the market and in this post, we will be covering only four methods. However, that being said, these four methods do count for a good percentage of trading methodologies currently in practice. Our apologies in advance if we have mis-labeled a blogger or if we have made an error of omission.

We personally partake in #1 and once in a while in #2. We do not trade in methods #3 or #4.

1. Scan charts at night looking for bullish/bearish patterns on the daily chart. Make a list, set your alerts, and the next day enter according to these alerts. This is simple break-out trading and this is what we do day in and day out. To summarize this in one line: trading based on support and resistance on the daily chart. The nuanced part comes in whether you take the trade or pass—and this is based on the intraday pattern, volume, market mood, et cetera. As far as we know, we practice this method, as well as Wall St. Warrior, Richard, DownTown Trader, Ugly, PinoyTrader, Tyro, Phileo, Bubs, Market Speculator, KnightTrader, and many others.

2. Repeat step #1 but also have a list of momentum stocks that are close to important spots, or which are trending in a clear direction. Use longer intraday time-frame for entry (for example, we use 10 day, 30 min or 10 day, 60 min while others prefer 5 day, 30 minute, et cetera). In terms of blog participants, basically same list as in #1.

3. Use a scanner to look for gap-ups/gap-downs with high volume and trade these stocks based purely on intraday patterns. This can be a successful method if one can come up with a sophisticated system for entry spots. In our opinion, this is the most difficult method to master as the decision process is more subtle, with more nuances and subjectivity than method #1 and #2. Candle-stick knowledge is a plus. Some successful participants of this method are Maoxian, Trader-X, Trader Mike, Estocastica, Trader Gav, Zoomie, Prospectus , Dave, and the promiscuous Ugly and Wall St Warrior who seem to partake in all three methods.

4. The last trading approximation really isn’t a method but it’s worth mentioning since probably most new traders enter trading via this methodology. No usage of daily charts, no usage of scanners, no real system: these traders often have a list of volatile stocks and look for intraday patterns to trade. These traders often hang out in large chat rooms, with hundreds of traders making different calls on anything that moves. They often buy/sell for very small moves, with a 1-1 risk/reward ratio. This isn’t really a system and this kind of scalping, in our opinion, has the lowest-win rate, and the highest burn-out rate. We know of no bloggers who would belong to this section.

Conclusion? As said, there are literally thousands of ways to make money in the market and what each individual has to do is to find their edge. However, in order to achieve the latter, one will require a disciplined system that can only come after a lot of pure, hard work. If you're lazy by nature, then trading might not be for you, and it might be best if you looked for a profession in the civil service (yes, yes, we're kidding, please no hate mail).

Wednesday, January 31, 2007

Volume Trumps Aesthetics

Wait for solid patterns to develop on the daily chart and then add an alert in your platform. Next day, watch the stock for a good intraday pattern (very similar to the type of pattern one would look for on a daily chart, just on the intraday level) and high volume. If both conditions are met, then pull the trigger. If neither condition is met, pass.

But what if only one condition is met? Probably the biggest mistake we make as a group (and some of us are more guilty than others, but all three have to work on this) is that we simply pass on trades too often. We always want our stock to set-up in some good-looking pattern, be it a consolidation pattern, a semi-circle, always a pattern with some kind of symmetry. At least a few times a week one of our stocks hits our number with no real pattern, BUT with strong volume. More often than not we pass on the trade and the stock ultimately moves in the intended direction. This seems to be a constant source of loss of opportunity.

Volume trumps Aesthetics. This means that if your stock hits your number with high-volume, but has no clear intraday pattern, it probably is still best to trust the number, and give it a shot (caveat -- we are NOT talking about buying on top of a vertical spike, that will always be a No-No). We know this but for some reason we're very slow to act accordingly -- probably not because it's a habit that results in losses, but rather something that holds us back from greater profits, and since we do well enough with the current way of trading, we just can't get motivated enough to change this bias.

The inverse, by the way, meaning a pretty set-up but with low volume, is still an avoid with the only possible exception being the thin stock whose volume comes in after the actual break...but that's still a roll of the dice.

As a first step to modify our bad habit we have printed a sign for the office:

High Volume + Daily Number = Profits

Let's see if it works.

Friday, January 26, 2007

TGIF

a post of collective wisdom on trading via Charles

Trin Talk from Richard

The always interesting StockTickr interviews, this one with DownTown Trader

If you're in or interested in entering a Prop Firm, you should read Ugly's post, as well as the relevant links

Sunday, January 21, 2007

Blogs of interest

StockBee -- A smart guy who is very much on top of the IBD scene

StockTrading101-- Good overall summary of the day and some great technical analysis on charts

Chris Perruna -- Very good technical and fundamental analysis on some of our favorite momentum stocks

Wallstreetfighter -- when you need a break and a laugh, it's a great place to go. We should probably add some kind of semi-R rating for this site. Well, not really, but it's not exactly your usual stock trading fare....

Visual Trader -- this is the sister site to KnightTrader, one of our favorite sites. This one is geared towards lower-priced stocks.

IceColdStocks -- a very popular site featuring stock commentary on podcasts

TazTrader -- Good over-all commentary; geared more for swing-traders and valuable information for those of you interested in candlestick patterns.

Monday, January 15, 2007

Recent Issues

DIVX EDU EFUT FFHL HLYS HMIN IPGP JCG MPEL NMX OMTR OPTM OSIR PNSN PWE RVBD SNCR VSE

Aside from the rather large Master List we have a mini-List which holds, in our opinion, the stocks that we need to pay attention to the most during the day. Our mini-list right now consists of:

Most important of all: NYX ICE MA BIDU GOOG RIMM AAPL AKAM HANS

ACOR AMAG ATHR ATI BRCM BSTE CAAS CAL CCOI CENX CEO CHAP CHDX CHL CME CNS CRDN CRM CROX CTRP CTSH DAKT DLB EDU EFUT FFHL FMCN FORM FSYS FWLT GES GFIG GHDX GLDN GMKT GRMN GROW GS GYMB HLYS HMIN ILMN INFY IPGP IPSU ISE ISRG JOYG JSDA JST LFC LIFC LRCX MBT MEND MFW MNST MPEL MR MSTR NCTY NDAQ NFLX NHWK NIHD NMX NRPH NTES NTGR NTRI NUE NVDA NVEC OEH OMCL OMG PCU PNSN PNTR POT PSUN RMBS RS RTI RVBD SHLD SNCR SNDK SPWR STLD STP SVVS SWN TEX TGEN TIE TS UA UAPH VIP VLO VOL WFR WYNN X ZOLL

Thursday, January 04, 2007

Some good reading

Sunday, December 24, 2006

Ten Lessons on Life that Apply to Trading:

2. Have perspective: Always keep the risk-reward in the back of your head before entering. If your stop is 50 cents, and your goal is 50 cents most likely all you’ll ever do is churn your account. Try not to enter until your reward outweighs your risk by a minimum margin of 2. It is very important in this career to be able to step-back and take things in with a bit of distance.

2. Have perspective: Always keep the risk-reward in the back of your head before entering. If your stop is 50 cents, and your goal is 50 cents most likely all you’ll ever do is churn your account. Try not to enter until your reward outweighs your risk by a minimum margin of 2. It is very important in this career to be able to step-back and take things in with a bit of distance. 3. Don’t be stingy: sacrifice the dime for the point. If resistance is 50 on a great break-out with a beautiful daily chart, and heavy volume, don’t take profits at 50.11 to lock in the dime, wait at least for a point (if you're a daytrader that is). Risk the dime for the point.

4. Accept the consequences of your actions: don’t blame anyone else but yourself for your mistakes, not the market-makers, not the specialists, not the plunge protection team, not your mother, just the person who actually pulled the trigger.

5. Be the Turtle and not the Hare: find a system that works (of course this is easier said that done), and then be patient and wait for your pitch. Don’t hop around from one methodology to another trying to make money every single day. Sometimes you just have to sit aside and let others have their turn.

6. Don’t be judgmental: there are literally thousands of ways to make money in the market. Choose yours, and respect others.

7. Don’t be greedy: one of the most common mistakes of newbies is buying the vertical spike up – they watch a stock move up a point in seconds, and they join the momentum so that they, too, can get an easy point in seconds. Most of the time, the only easy thing is the immediate reversal as experienced traders sell into the spike.

7. Don’t be greedy: one of the most common mistakes of newbies is buying the vertical spike up – they watch a stock move up a point in seconds, and they join the momentum so that they, too, can get an easy point in seconds. Most of the time, the only easy thing is the immediate reversal as experienced traders sell into the spike. 8. Focus on your goal and work hard: Try not to get distracted by chatrooms, noise, phone calls, and CNBC (not to mention all the traders we know who have porn on in the background). During the trading hours, focus on the objective and nothing else.

9. Don’t be an idiot: as we have often said in our newsletter; losing is an integral part of this business, but if you’re going to lose money, then at least lose it on a great set-up that just didn’t work out instead of some lame trade that you normally would have never pulled the trigger on. Let’s say stock HCPG breaks-out on the daily charts at 50 with excellent volume and a great intraday set-up. You take a position at 50.06 and later on in the day are stopped out at 49.8. Now that’s a normal loss and one is that completely part of the business and in the long run, unavoidable. However, buying a penny-stock because of something you read/overheard in a message board/blog/party is a stupid loss and something that is completely avoidable. Remember how easy it is to lose, and how hard it is to consistently win.

10. Be Good: events are more interconnected than you think. Have some karmic fear: Try not to live a life which will lead you to be reborn into a toad. Be kind, work hard, help others, be smart, and eventually, everything else will fall into place.

Tuesday, December 19, 2006

If you're going to be trading throughout the week, use extra caution since the volume should slow down to a crawl as we approach the holidays. Stay well, and be smart.

Wednesday, December 06, 2006

Time frames

We use several time-frames: 1 minute, 3 minutes, 10 minutes, and--usually after market close--30 minutes, 60 minutes, and daily and weekly. The longer time-frames are used to identify candidates to trade on the following next day. Once the market opens we usually stick to the 3-minute time-frame. In all our years of trading, we had not met -- until very recently-- people who daytrade from a 30-minute chart. Hats off to all you traders who use the 30 min timeframe for day-trading: It is an incredible feat.

We probably would miss out on at least 90% of our selections if we used anything longer than a 5-minute time-frame. Take a look at the following two charts. The first, a 3 minute showing a "base and explode" pattern, is our bread and butter set-up. The second chart, using a 30 min time frame, gives us no information.

It's true that 30-minute frames cut out a lot of noise, but they also delete critical data (for our kind of trading). Let's use an analogy:

3-minute time-frame: Two lovers talking on the phone with, naturally, a lot of phatic communication and meaningless information including sighs, giggles, pauses, baby sounds, more adult signals, and so on. Think of how much information is conveyed when the man asks, "so how is out working out with that new guy at the office," and there is a slight pause, just an instant too long or too short, before the woman responds, in a slightly too hurried voice, "good, good, and how was your day ". So much can be read into that pause, and so much of our understanding of what someone is trying to communicate comes from the "noise" or what is not said in between the words.

30-minute time-frame: Two lovers communicating by telegraph. One writes, "How is new guy at office," and the other responds "Good". The message is received and the noise is filtered out, but along with that, so is a ton of data.

We're not writing this to change anyone's style from longer time-frames to shorter time-frames, not at all: Each style of trading requires its own means and methodology, and judging by what we have seen these last six months in various blogs, there are many traders who day-trade from a 30-minute chart, and do so successfully. We respect these traders very much and are always amazed at how many ways there are to make a living from mother market.

For our style of momentum-trading however, we have yet to come across anybody that has used a 30-minute chart. Ugly is doing something very unique, and so far quite successful, by combining daily charts with 30-minute time-frames. It's something that intrigues us very much. We have faith he will develop his system enough that it will work consistenly over time (and if not, the ATS will take over).

So, to conclude, hats off to you 30-min traders! This is a difficult business and anyone who can come up with a system to consistently pay the bills has our respect.

Saturday, November 25, 2006

A word about Blogs and Ads

However, let's start with the positive. Over this period of time we’ve been very impressed by the breadth of knowledge of many blogwriters, but even more so by the camaraderie and generosity shown by our colleagues. Let us give you an example. We started up this little business 6 months ago called Highchartpatterns.com. Now as you also very likely know, there’s a lot of competition out there in the newsletter business, and for the most part the commercial sector of advisory services, such as the one we partake in, is not one in which people try to help each other; in fact, one of the main goals is to take customers away from each other in order to achieve supremacy. Anyway, this weekend we received an email from a very cool fellow called Declan Fallon who runs Fallond Picks, a swing-trade service. Declan wrote to us about how he visited our website and how he had a few recommendations (for example, he said that we might think about changing the font/color of our text as it blended in too much with the background – something we changed the day after thanks to his advice). He basically introduced himself and wished us the best and great success. Now to repeat, this guy is our competition! Where in the world do you find such class and genorisity in the corporate world? We highly respect this; we are not only superstitious (like many traders) but we are also believers of karma -- and to the best of our admitted limited capacity, we also try to emulate these noble traits. The blogosphere seems to exhibit many positive features, and appears to be still more grass-roots oriented. To a certain extent it still shuns that world that most likely will ultimately envelop it, as the cannibalization of capitalism leaves few stones unturned.

This brings us to the subject of ads. Recently we have read in several sites people commenting in a negative way on blogs that have ads with the implication that if these blog-writers were "better traders" then they would not need revenue from ads. To us, this is completely ridiculous. Why in the world would people expect something for free? One can only guess at the amount of hours Charles Kirk dedicates to his website (even though he doesn’t have ads, he asks for donations in order to enter his Member area), or the time and labor necessary to provide the incredible education you can find on TraderMike’s blog. The amount of work that Mike has put into his blog over the years is unbelievable, and yet we read a derogatory comment a few weeks ago on the ads on his site. Come on. Did Mike go through some religious experience at a young age in which he promised his God that he would serve the people with hours of his time for absolutely no reward?

Richard has come up with his own unique scan formula that spits out great trading candidates every day; and now he even generously allows others to post on his site, would you begrudge him the bit of lunch money that he makes through his ads? Why can’t he get himself a nice steak dinner from his AdSense money, or even better, get himself a couple massages once in a while? Doesn’t he deserve it?

Our friend at Knight Trader, who has a style of trading very similar to ours, offers a great blog (and we have no idea how he has the time for it during the trading day) in which he lists, in real-time, stocks that are showing momentum. His blog has ads. Good for you, and we hope you make a mint. Ugly’s blog improves on a daily basis – the humor and education one finds in his blog makes it addictive. We can’t go a day without reading Ugly. He’s innovative and smart and obviously spends a lot of time making his blog one of the best out there. And we hope your ads buy you many many boxes of wine, buddy.

Dave at StockTickr offers a fantastic service, mostly for free, and if you want the full features, you sign-up for the Pro version for a nominal fee. Shame on you, Dave, for wanting to charge $10 a month per subscriber for the hundreds of hours you put into your business every month! Yes, of course, we’re kidding and we think his business plan is great. While we’re on that note, of course, Trade Ideas should be free too…

If you choose not to place ads on your site, great. We ourselves don’t have any ads, but we have absolutely no ethical issue against it, the only reason we don’t is, well, we can’t really be bothered, and two, we don’t have the traffic to really pull in any decent money (remember everything is divided into three here at HCPG HQ). But if we had the traffic that would pull in a couple G each every month, for doing no extra work, would we? Of course! Why in the world would we give that up? That money could go towards the future education of our children, it could go to our favorite charities, or it could go towards a vacation – what is the moral issue against not being paid for your work? Is there an unwritten rule that one should not be compensated for one’s work on the Internet?

The same applies to membership fees. We charge $37.50 a month for our newsletter that comes out five times a week. Undoubtedly, this means that all three of us are close to blowing our accounts, being lousy traders who can’t make a decent living off our collective two decades of professional trading and thus have been reduced to selling newsletters. Of course the same logic would apply to Steven Cohen, who runs one of the best hedge funds of our time and who also incidentally charges one of the highest fees of all hedge funds. He should really do it for free. Come on Stevie.

Again we digress. Where were we? Oh yes, charging membership fees appears to signify lousy non-profitable trading over the years on our part. Or maybe, it could mean that we wanted to start up something that would inspire us to become better and at the same time would help others evolve into more profitable traders. Why not do it for free? Why in the world would we do it for free? What is free in life? After you finish work do you go vacuum your neighbor’s house? Our time is precious and we spend an inordinate amount of it trying to make our newsletter the best newsletter possible. Why shouldn’t we be compensated for this? The modern world thrives on division of labor. The amount of time we save our subscribers in terms of scanning for stock picks makes it their worthwhile to pay the $1.87 each weekday. Let's say we save them 45 minutes each day. How much are those 45 minutes worth? Besides, if we did do it for free (we could imagine doing the blog for free, without the newsletter), we would never feel the same motivation and responsibility in regard to the quality of our work. For all those blogs providing content ad-free, fantastic, and thank you. And for all those blogs providing content with ads, fantastic, and thank you.

Tuesday, November 21, 2006

Eternal topics

There are some topics that are omnipresent in our business. Poker and Trading, Chess and Trading, Gambling versus Trading, Day Trading versus Swing Trading, .....

Here is a great post by Downtown Trader called Who is the House?. Enjoy.

Friday, November 17, 2006

Correlation between indices and break-out trading

One of the most interesting aspects of writing our newsletter is that we now notice connections, or a lack thereof, that we had never caught sight of before. Because we now keep meticulous statistics on all of our picks, we discern patterns that are new to us. For example, in our case anyway, the correlation between the indices and break-out trading is much more random than we had previously thought. June and October were our best months: yet in June the market did very little whereas it rallied in October. However, we are having a difficult time finding interesting new break-outs in November; in fact this month we have had the least amount of selections that we have ever had -- all the while the Nasdaq has rallied strongly into new highs. So far in November we have had 8 selections trigger -- at this time in October that number was 30. Is it us? We doubt it -- we are pretty automatic in our chart selections with very little subjectivity: we go through hundreds of charts independently every night and almost always come up with the exact same picks. The set-ups are either there or they are not there. And right now, the charts that we seek are simply not there.

The only explanation we can come up with is that when the market becomes this overbought, the best moves are continuation moves (like in RIMM which just keeps going up) instead of actual new break-outs. What is the best time for us? A market coming off the bottom or a market that has consolidated for several weeks. This market refuses to consolidate and keeps going up every day. All good things will end, of course, and nothing would please us more than a couple nice big juicy red days. Why? Because ironically, that would set-up many more patterns than the current environment. Until then though, we will keep our cool, surf the net, watch Ugly's kung-fu videos, and wait for our turn.

Wednesday, November 08, 2006

The five horsemen of 2006

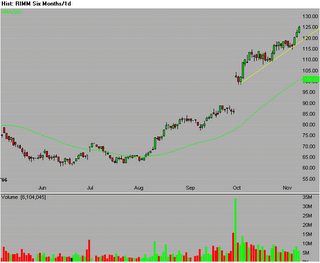

RIMM is without a doubt the leader of the momentum group and could not act any better. 115 was the recent breakout and look how well she held that number, even through recent market weakness.

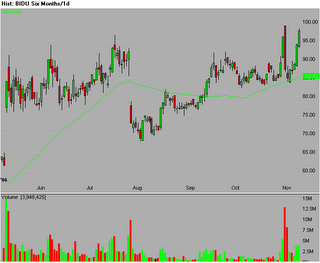

BIDU has recovered nicely and can potentially set-up very well for a swing-trade if she can consolidate a bit more under this 100 area.

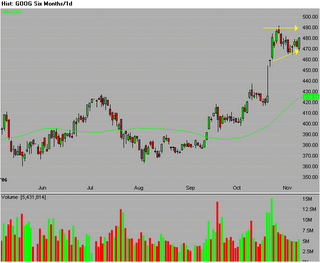

GOOG is looking good and looks set to break into new highs.

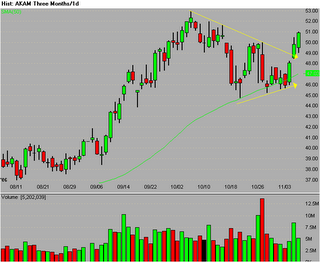

Look how well AKAM resurrected herself. Only last week she looked uber-bearish, hugging the bottom of her pennant and closing under her 50dma. However, she never broke down and bounced off her support like a champ.

This next little while should take us out of this recent range and hopefully set-up some great chart patterns. And one more thing to add: as bullish as these charts look, we're also aware that often these kind of posts from traders showing the "great leader action" can also mark the absolute top of a market. Let's see which one it turns out to be: as always, we'll react and not anticipate.

Monday, October 30, 2006

Consistency? Whose consistency?

We are also very consistent when it comes to the kind of charts we seek -- this does not change month over month. The only variable is how benevolent the market feels, i.e., how many charts fulfill our conditions and whether the break-out works or fails. We have kept public records of all our selections now for 5 months. Our best months, in terms of win-loss, have been June and October, and our weakest were August and September. Now did we pat ourselves in the back at the end of October, and kick ourselves at the end of August? No. Just as we felt we did nothing special to have a good October, we felt that we did nothing wrong to have a less-than stellar August.

This is something that traders have to become accustomed to -- your trading technique, whatever it may be, will rarely achive the same level of success every month. The market will favor your methodology on one occasion, and then leave you behind in the dust on another. The key is to add size when the market is treating you well, and conversely, protect your capital and try to grind together a small amount of profit when the going gets tough. That is not the time to be aggressive; rather, use smaller size and stay patient until it's your turn again. Theoretically, it may be possible to constantly adapt one's style of trading to ensure that it is always favored by the market; however, we are neither that ambitious nor that smart (nor do we know of anyone who can do that successfully).

We know we are consistent. But we also know that the market is not. Remember that for your own trading, and it will be a source of strength to draw upon, in good times and in bad. When the going gets rough, stay calm and collected, and above all, do not lose your control and discipline. In our career, losing one's discipline even for a day can make or break one's whole quarter. And just as importantly, when things are good, be aggressive, and strike with that hot iron in order to save up for when the draught begins. But do know that the good times also will end. And thus continues the cycle.

Sunday, October 29, 2006

A message to our newbie traders

A: Novice Traders who need to learn a system of how to trade, and more specifically, how to spot and interpret daily and intraday patterns.

B: Intermediate Traders who need a refresher course or want a confirmation of their own readings on the market.

C: Advanced Traders who want another pair of eyes looking for possible set-ups.

Today, we'd like to expand on this by concentrating on the beginners. For newbie traders, our system--like any other closed system that provides background, analysis, and advice for a specific area--holds a certain fascination. We tell them what stocks to watch, when to enter, when to take profits, and when to cut your losses. If you're new you can learn a lot from this: you can familiarize yourself with a successful system, you can recognize what kind of charts work, and what kind of charts do not, you can learn how professional traders interpret patterns.

However, there comes a time when you must start applying our teachings to your own data. We recommend that after several months of successful trading you start running your own scans or looking through your own list of stocks.

Set alerts on charts that you like -- if they coincide with ours, great, if not, trade them anyway.

Why do we say this? We're 3 traders who send you a newsletter for basically the price of a buck a day. All we should do for you if you are new is to teach you what kind of charts to look at, and to understand what kind of intraday conditions are of importance when you plan to enter a position. After a while, you will enter the ranks of the majority of our subscribers who use us to supplement their own readings and watch-lists. Ultimately, this is where we want you to go. Why do we say this? Well, for one, you should never rely on anyone but yourself. What if we decide to close our doors, retire young, or run into unforeseen circumstances? (We're only saying this rhetorically, of course -- we'd like to be around for a long time since writing this newsletter has been one of the best decisions we have ever made). Second, you will never be able to gain the required confidence if you do not at some time stand on your own and trade your own selections. And without confidence, you will never be able to evolve into a strong enough swimmer to tackle the shark-infested, murky waters of the world of finance.

Thursday, October 05, 2006

When your System Fails You

No trading system functions every day, in every type of market. We are break-out, momentum traders who use a system with a very tight stop (1%): in choppy markets we will get hit. This has always been the case and always will be. Today was the first day within our service that we had 3 triggers and 3 losses but it will most likely not be the last. All 3 stocks triggered, all reversed with the market to hit the stop loss, and then all 3 reversed yet again and at one time or another went above our alert prices. It's a perfect example of what happens in a choppy market.

What do we do? We pull back, regroup, become more cautious, and ultimately sit things out until things improve.

Now, if our trading system were brand-new to us then we might be concerned, but the years of successful experience that we carry with us give us confidence, faith, and vision. The current trading environment (which alternatively might be great for other types of traders) that is very challenging for us, will also pass. One thing we have learnt over the years is to always have perspective and take the bad, and the good, in stride.

Friday, September 29, 2006

The Fine Line

We mentioned in our last blog that we felt that we made a mistake this month in being too conservative. Unfortunately, this is a consequence of choppy markets. On one hand, you should become more selective since the failure rate in such market environments are higher than usual. However, one has to walk a fine line between being smart and selective, and not becoming too scared and gun-shy, since in the long-run becoming too fearful of the markets can be just as damaging as being overly aggressive. We've often said that there's nothing easy in this profession, and finding this fine line of being selective and yet involved, is something that can be difficult to capture.

This is how we do it: as our readers know, we only trade from a predefined list from the night before. Therefore, when a stock hits our alert, we already know that it has a solid daily. In benign markets we sometimes take a trade with a solid daily but a questionable intraday pattern, or with mediocre volume. In these types of markets we don't do that -- we wait for the ducks to line up. The daily we already know is solid, now we wait for the intraday and the volume to confirm. If there is any element lacking -- i.e. the volume is mediocre, or the intraday is too much of a chase, then we pass.

This means we sometimes miss good moves, but it also means that we stay away from a signficant amount of failures. This is not only good for one's account, but very important for one's confidence. Stay involved, don't get scared, take your cue from the market and when things just aren't working, then know it's ok to pass. But jump back in the game the next day and start fresh. And whatever you do, don't freeze like a scared monkey.